Explore The Options For Your Financial Future –

This initial planning stage revolves around you. Before you can get to your Wealth Building Plan, you first have to know who you are, your goals, and the different concepts that impact your eventual success in achieving your ultimate goal of taking control of your financial future.

When I talk about Planning in this context, it’s more about feeling comfortable with the Direction you want to take, setting the stage for your ultimate Wealth Building Plan, rather than developing your working plan, which will come together when you Start Creating Your Wealth Plan.

You’ll Answer the Question: Why?

Knowing yourself and your goals in life is a prerequisite to knowing why you want to take control of your financial future. It’s important to evaluate your situation and fit your Wealth Building Plan to your unique circumstances, so you can pursue your goals with the wind at your back.

Your Psychological Make-up will have a great influence on how you manage your wealth, how you plan in the beginning, and how you carry out the action phase. Knowing yourself puts you in a position to make the right decisions about the path to take in your wealth building journey. Planning Basics can also be used to develop realistic goals that you can wrap your Wealth Building Plan around. Some of the questions to answer at this stage are:

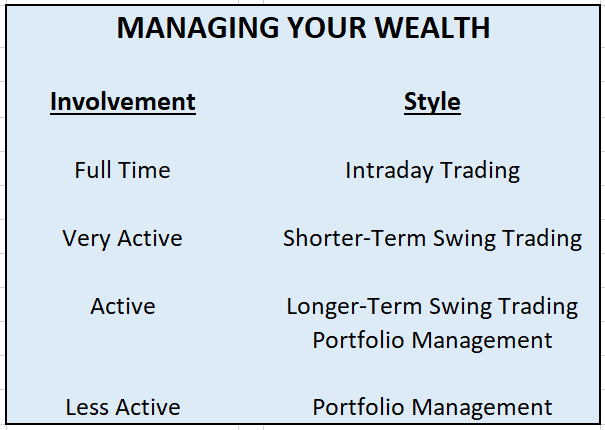

- How much Involvement do you envision? This goes along with the Direction you want to take and the objectives you have or want to develop. My vision of the Self-Directed Wealth Builders of the world includes the ability to manage their own time and effort to achieve their goals; so, this part of your life can be very flexible. For instance, a full-time income can be had Intraday Trading just two hours or less per day. Wealth building doesn’t have to be all-consuming. I’ve expanded on the time element of your involvement below in the next section, so you can see how it relates to the Style of trading you may be interested in or need to consider.

- What Direction do you want to take? What Style of trading would you be comfortable managing? Do you want to trade solely for income, manage your wealth while working at your true calling, or don’t you know what direction to take right now and need to learn more? Below, under “Explore Your Wealth Building Direction”, are six scenarios that I’ll be developing into trading plans and can be used to see what Direction makes sense for you right now.

- How will your Lifestyle, or the lifestyle you want to create, influence the way you manage your wealth? This relates to the amount of your involvement in managing your wealth and what Direction you end up taking. Wealth building plans can be structured for any lifestyle, as long as you have a good grasp of the variables involved.

- What is your Risk Tolerance? The traditional view is to categorize someone as Conservative, Moderate, or Aggressive in their financial life. That works well when you’re picking investment choices managed by others. But, as a self-directed wealth builder, risk tolerance goes beyond the passive and becomes a part of your life. You’re making the trades, so your risk tolerance ends up on a very personal level. Risk to your portfolio is one of the most important aspects to consider – so, make it part of your plan to never lose money.

- What amount of Capital do you have to manage? The Wealth Building Plans should take care of what Style and Method of trading can be used for various capital levels, but, for the moment, know that the size of your account will have an influence on where you start and how you build your wealth – that’s part of the planning process. A note on Methods: If you ever get to a point where you want to trade Stocks, ETFs, or Options intraday, remember that you need a minimum of $25,000 in your account to get started (the Pattern Day Trading Rule). Other than that, when discussing Wealth Building Plans, I’m going to use the following capital levels:

Small Less than $25,000

Medium Plus or Minus $100,000

Large $500,000 to $1 Million plus

- What is your Experience level in the marketplace and Knowledge of trading in general? How much and what kind of education are you going to need to meet your goals? There’s a plan for all levels and the education and training to match – the versatility is built-in.

Having an understanding of these concepts and applying them to your life will establish where you should start in the very practical next step of developing your Plan and setting the stage for building your wealth.

Happily, the process of creating a Wealth Building Plan here at The Diversified Trader will bring these variables together, along with the Methods to execute the plan, and give you the confidence that your goals will finally be met.

When you know the Direction you want to take and have your Wealth Building Plan ready to go, Your Trading Partners then become the link that will execute your Methods to make your Plan work. Your trading partners will be your key to success and will provide the expertise and market intelligence to “take advantage of the Market, not depend on it”.

When you know the Direction you want to take and have your Wealth Building Plan ready to go, Your Trading Partners then become the link that will execute your Methods to make your Plan work. Your trading partners will be your key to success and will provide the expertise and market intelligence to “take advantage of the Market, not depend on it”.

Know the Involvement It Takes to Manage Your Wealth

The amount of your involvement in the wealth management process will influence your lifestyle, so choosing the right combination of Styles and Methods becomes very important. Whether you fit your Wealth Building Plan to your lifestyle or create a new lifestyle base around your long wished for goals, learning about your wealth management options is an exercise well worth the effort. I found early on that the marketplace of education and training services was so confusing that any hope of finding the path to independent wealth management success disappeared in the maze.

The structure I’ve developed within The Diversified Trader is there to solve the problem of choosing your best wealth management options and give you the platform to find your way to the perfect wealth building combination.

Different Styles of trading take different commitments to be successful, and it’s well worth knowing what they are before developing your Plan. Here’s a look at the major differences in the amount of your involvement between the dominant styles:

This rather broad classification can be misleading at first blush, and only with experience can you understand the flexibility you have in managing your wealth. That flexibility is what makes developing a Wealth Building Plan that matches your goals even possible. To clarify the classifications:

“Involvement” refers to how much effort you have to put into managing any Style of trading, not particularly in the time you spend doing it.

For instance, when I talk about “Full Time” involvement for Intraday Trading, I’m referring to having to be immersed in market intelligence and the behavior of the Vehicles you’re trading on a regular basis, so that when you trade you have the best information possible to be productive. I’m not talking about spending your life in front of a computer. As I mentioned above, a full-time income can be had by trading two hours or less per day.

With any Wealth Building Plan, time has to be spent keeping up with research, changing market conditions, and planning the next day’s activity, but, beyond your initial learning curve, that knowledge becomes a part of your life with any amount of involvement you choose. Using Futures and Forex, trading can be done at different times of the day or night, so you’re not constrained by being occupied during the business day. Other than that, your involvement in managing your own money is dictated by your Wealth Building Plan. We retired folks, for instance, are fascinated with the challenge and happy to have short-term trading Methods to balance our portfolios for consistent growth and to manage changing market conditions.

Shorter-Term Swing Trading with Options is the most versatile of the Methods and the most popular, due to its flexibility and favorable management requirements.

I say your involvement is “Very Active”, again, based on your level of focus on the markets and individual securities underlying the Options you’re trading. This is the best choice if you work or run a business and can’t trade during market hours. Trades lasting several days to a week or two can be setup in the evening and monitored on a daily basis, leaving you free during the day.

Explore Your Wealth Building Direction

Involvement and Direction are the two sides of the same coin. They must be taken together along with the other criteria above in determining your best path to managing your wealth. I’ve summarized those variables in the next section, so you can do your initial planning to lay the groundwork for your ultimate plan. But, for now, focus on looking at the various Directions to get a feel for the most logical one that fits your situation right now.

To get the ball rolling, take a look at the six scenarios below to see if any reflect where your objectives are right now. Even if you’re just Getting Started on this journey and haven’t gone beyond knowing you need a plan, you will have established an initial direction on which to build. That’s a huge step toward getting a handle on your financial well-being. For that matter:

The objectives of every scenario will need a Plan to meet your goals, and Getting Started forms the foundation.

From there, more specific plans developed based on each of the other scenarios will give you the Direction you need to complete the next phase of your longer-term Plan.

Your Wealth Building Direction

Getting Started

1 (GS) – You don’t have a clue how to get started, but you now know a Wealth Building Plan is the best path to take and need help putting together the right plan for your unique situation.

Trading for Income

2 (TI1) – You have the time to trade your own account and want to learn how to add Intraday Trading to your Wealth Building Plan and produce consistent income with limited market risk.

3 (TI2) – You’re looking for income beyond what the financial services industry can produce and want to protect and grow the wealth you have, but you don’t want to spend a lot of time doing it.

Trading for Growth

4 (TG) – Your financial situation isn’t where you’d like it to be, and you want to generate consistent growth to meet your life’s goals and never lose money to the “market” again – you have the will to manage your financial destiny and need to find the way.

Trading for Wealth

5 (TW1) – You have the time and the money and want to manage your wealth to generate better returns than what the financial services industry can muster and gain the confidence that you really can control your financial future.

6 (TW2) – Your career or business is doing great, and you know you need a plan to grow and protect your wealth for long-term security.

You may find that more than one scenario will come to play a role as you evolve and have success at each stage of your wealth building journey. The idea is to mix-and-match the various wealth building Directions to meet your needs along the way. The expertise and training are there – putting together the right combination is the key.

Let the Planning Begin – From Where You Are Right Now

Having a vision of where you are right now will give you the basis upon which to build your Plan to get to where you want to go, even though the specifics are still hazy. More often than not, your Plan will evolve as you grow in experience and knowledge; so, your final destination may not even be visible now. For planning purposes, though, and to have a structure to actually get started building your wealth, creating an initial Plan based on current knowledge and goals is the first step in your longer journey.

In effect, you’re letting your evolution begin.

At this initial planning stage, we’re looking at who you are and the influence your unique situation has on how you can start to take control of your financial future. Having an idea where you stand as we begin looking at various wealth building plans will have you on the right track. Summarizing what we’ve discussed, here are the important criteria that will impact which Plan you follow:

Your Initial Planning

Involvement –

Direction – Getting Started with an eye to the future.

Lifestyle – How much involvement does your lifestyle allow?

Risk Tolerance – Based on the level of trading activity.

Capital to be managed –

Small – Need to grow your account.

Medium – Income and growth.

Large – Greater return on investment and growth.

Experience and Knowledge –

None – Start your education with The Diversified Trader.

Moderate – Look for specific training to complement your Plan.

Extensive – Develop new avenues to diversify Style and Method.

Write down where you stand in your initial planning, using the topics above and any goals you have at this beginning stage; you’ll be in a much better position to decide on a plan of action. You’ll be able to match your personal situation to one of the six Direction alternatives, or scenarios, above that will become your Wealth Building Plan.

Everything here at The Diversified Trader is built to put you ahead of the curve when looking at your alternatives. If you’re new to the world of trading, what you learn here will give you the basic understanding you need to evaluate your choices.

As you grow, always look for the next step in your Wealth Building Plan and continue building toward being truly diversified by trading Style and Method. Expand your horizons with the insights you’ll learn here at The Diversified Trader to always be in control of the marketplace and new developments that by the nature of the world happen all too consistently.

Let your journey begin with the discipline of Getting Started. This is where you’ll see how the process unfolds by taking the steps you’ll need to get you to the starting gate.

Getting Started now is your best motivation – it’ll grow on you.

To Your Wealth Building Success,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

If you’re not already in the loop, get a head start on navigating The Diversified Trader and finding the right path to taking control of your financial future by reading The Diversified Trader – An Overview.