What’s in a Trading Method

The Building Blocks of Your Success –

When I first looked at the financial markets and wondered how they worked and what would be the best approach to building wealth, I was confused and defaulted to the traditional method of investing by putting my money in the institutional marketplace. And then the financial advisor or retail broker would recommend certain financial assets (Stocks, ETFs, Mutual Funds, Bonds, etc…) to build my portfolio or, when I had enough money, put my money in their own “Managed Funds” specializing in select markets or investment objectives. That was supposed to work on a fundamental basis over a long period of time, but, when a market downturn hit, you were at the mercy of the market. I don’t know about you, but my life can’t wait for forces beyond my control to cooperate. So, with no effective short-term market risk management over my assets, …

… I soon found the Traditional Methods didn’t Work.

That’s the way it was until I found out what the marketplace was all about and that “buy and hold” investing would never build my wealth – no one had my best interest at heart and had their priorities firmly pointing in their direction. When I realized the best way to control your own financial future was to do it yourself, my whole perception changed, and I set out to find the right path to wealth building success. After twenty years of experience in the marketplace, I created The Diversified Trader as the result of my quest, and that’s where I show you the culmination of my research and what I found to be the definitive path to controlling your own financial destiny.

Your wealth building journey begins by learning what the marketplace looks like, with all its moving parts, and then evolves into creating a Wealth Building Plan designed to light the path to your financial future.

The Diversified Trader is here to give you a platform to do just that.

Your Wealth Building Plan comes first, along with the education you’ll find right here to shift your mindset into the right gear, and then the Methods you’ll use to achieve your goals become the building blocks of your success.

The Moving Parts of a Method –

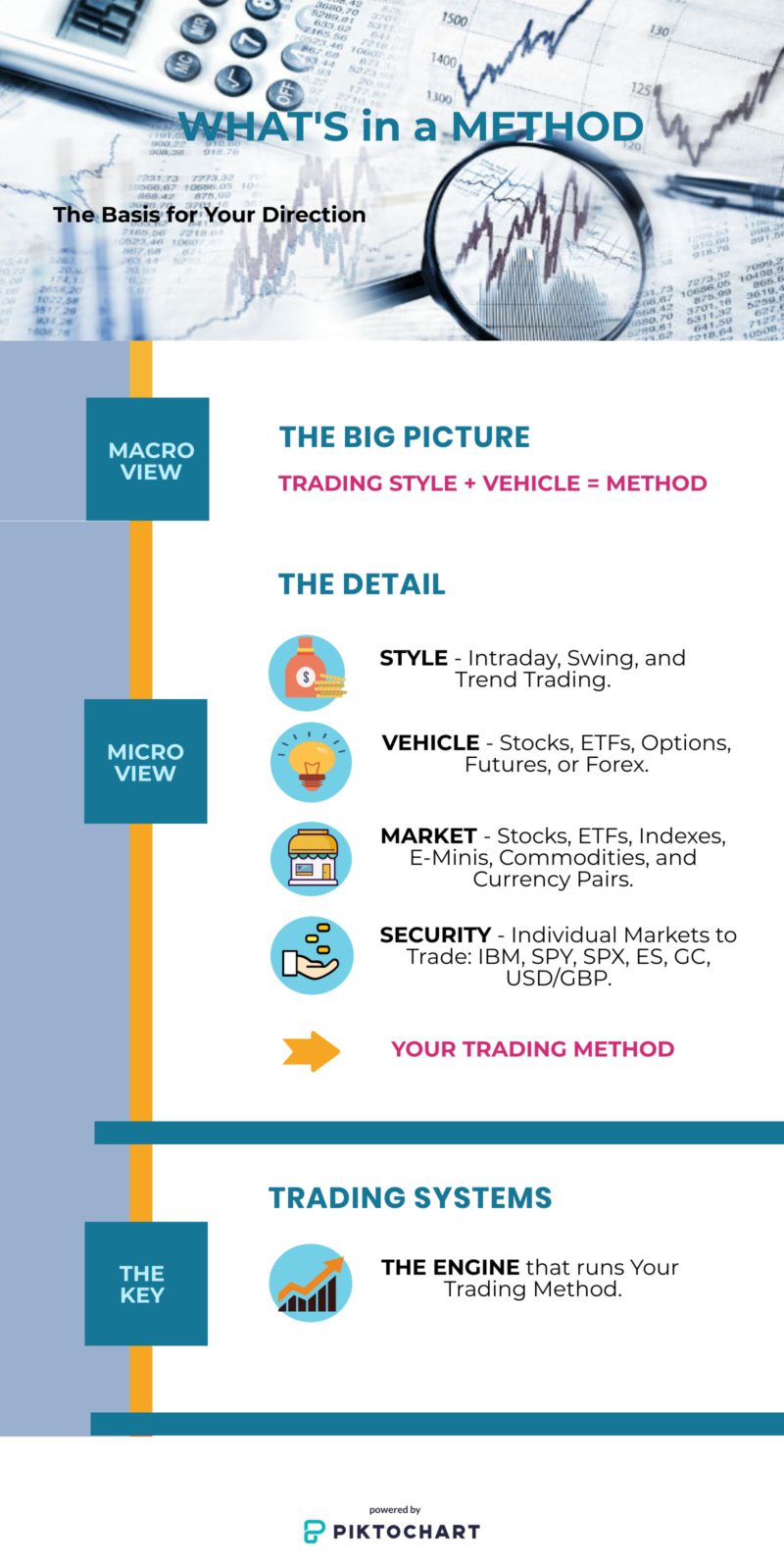

Basically, combining a Style of trading (Intraday, Swing, or Trend) with a Vehicle of choice (Stocks, ETFs, Options, Futures, or Forex) constitutes the structure of a Method. Everything you do to make all the parts of your Wealth Building Plan work revolve around this basic concept.

When you identify the specific class of Markets to use in your Wealth Building Plan (Stocks, ETFs, Indexes, E-Minis, Commodities, and Currency Pairs) within the broad Vehicle classification and then choose individual Securities to trade within those Markets, you create the detailed Trading Methods you’ll be using within your Wealth Building Plan.

Adding the right Trading Systems to your Methods will form the engine that will drive the Direction you’ve chosen to fulfill your goals.

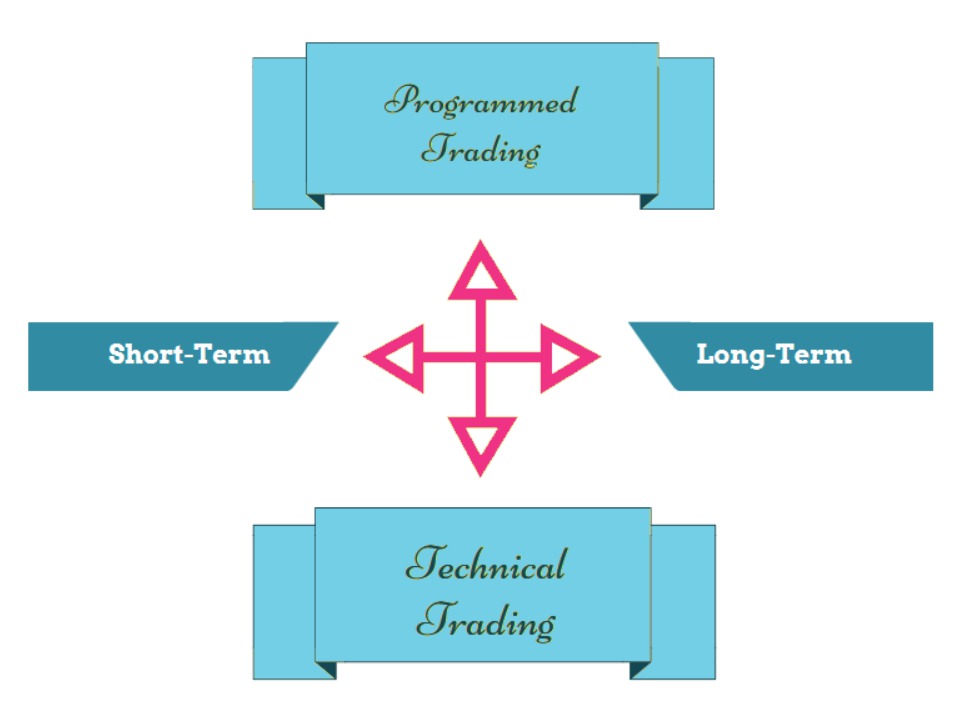

So, to make Your Trading Methods work, your final step is to embrace Systems (Programmed or Technical) that ensure your Methods’ success. You’ll see, as your education grows, that choosing the right Systems is subjective in the sense that the marketplace is filled with Systems of all shapes and sizes, good and bad, for any Method you want to pick.

The trick is to find the Right Systems.

The Method doesn’t change, but choosing the right System is critical to your success.

When it came to charting the path to your financial future, finding that right System for each Method was the most frustrating part of my mission. There were too many alternatives and no way to filter out the ones that wouldn’t work without testing them all. I experimented with a good majority of the Systems in the marketplace and realized the process was way too expensive and disjointed to be productive for anyone.

However, with all my research and personal experience, I was able to develop an evaluation technique to determine the best education and trading services to use for any particular Method – something you won’t have to do. Also, it became apparent early on that no one System would work for all Methods, so multiple Systems had to be incorporated within any Wealth Building Plan.

A major part of my mission for The Diversified Trader is to find Systems that I think are the best for any Direction and Method, so you won’t have to waste a lot of time and money searching through the maze of offerings.

That’s where Your Trading Partners come into play and are so important to your success. They develop the Systems for the Methods you’ll be using and maintain system integrity in relation to current market conditions. I’ve seen or heard of many people that have tried to jump into trading or tried to build a portfolio of stocks and ETFs on their own that eventually failed in the attempt. It’s so important to have professional traders guiding the way and providing that Market Intelligence so necessary to managing your wealth.

My overall purpose is to put you on the right track to achieve your financial goals, so you can develop the confidence to determine your own financial destiny.

The best way to do that, in my opinion, is to learn about the marketplace, the Styles and Vehicles to use, and then create a Wealth Building Plan based on the Direction you want to take. All that can be done right here with The Diversified Trader before you spend any money, so you know you have the right Systems for the Methods you’ve determined will make your Plan work.

Your Trading Partners run the Systems that run the Methods that run Your Wealth Building Plan. Choose your Methods and Systems carefully, so you can truly “Take Control of Your Financial Future”.

The Covered Methods –

You will never find the pot of gold by chasing rainbows or find that gem in any market that’s going to make your dreams come true. No single event or secret system will ever make that happen. The Methods I’m including here for developing and running your Wealth Building Plan are all that you need to take control of your financial destiny and achieve consistent growth and income.

By changing your mindset and following the prescriptions I’ve laid out for you in The Diversified Trader, you’ll be using the fluctuations in the individual Securities you’ve chosen to trade to grow your wealth, rather than forever trying to pick the next big winner. By knowing the Securities you’re using, you increase your control over the market and enhance the consistency you’ll need to succeed.

The list below will give you the universe of Methods to use when structuring your Wealth Building Plan, depending on your Direction and available capital, so you can Start Creating Your Wealth Plan.

The Diversified Trader will put you on the right path to becoming that self-directed wealth builder with all the right Methods and related Systems that can make building lasting wealth a reality. Get a peek at my philosophy and wealth building process by learning You Really Can Manage Your Own Money.

There is a Method for the Market Madness

Here’s to a Better Life,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

- If you’re new to all this and would like to learn the key to managing your own money, have a look at Education – The Path to Independent Wealth Management. Then, to find the right path to get you there, The Diversified Trader – An Overview will give you my recipe for getting started taking control of your financial future.