Your Wealth Building Steppingstones:

Know the Importance of Becoming a Self-Directed Wealth Builder

Understand the Trading Landscape

Know Where You’re Going

Set the Stage

Get Started

Step One – Know the Importance of Becoming a Self-Directed Wealth Builder

Just knowing you’re in control of your financial future makes doing everything else so much easier. Your career may be tied to a particular company, and you want to make sure you’re covered if anything happens to change that. You may want to change your life completely and follow that dream that’s been tugging at your soul. Or, maybe growing your wealth consistently with above “market” returns is just what the doctor ordered. Any way you look at it, the security of knowing you’re in control of your goals makes living life on your own terms the place to be.

As I’ve mentioned before, leaving your financial life in the hands of the financial services industry takes you out of control and makes you dependent on the “market”.

Hoping your pension plan or 401k account will take care of everything will just get you to the same place. The only way you can ensure your financial health is through taking control and managing it yourself. If you haven’t already, read The Case for Taking Control of Your Financial Future for some more insight.

My vision for managing your wealth for long-term growth includes using expertise in the marketplace to “trade”, not Invest, every section of your Wealth Building Plan to be able to take advantage of the volatility in the market and manage market risk.

Instead of trying to find your own way through the maze of money management alternatives in the marketplace, the plan becomes to understand your goals, and then use your Wealth Building Plan to help you manage and grow your wealth.

I set up The Diversified Trader to show people that they could manage their own wealth and not be intimidated or confused by the marketplace, along with providing the framework to make that happen. You Really Can Manage Your Own Money will give you an overview of the process I think is the best path to success for the individual. You’ll see, as your Plan develops, that being in control of your Wealth Building Plan allows you to manage the direction you’ll take and not be left at the mercy of the market.

Coordinating all of your plans here at The Diversified Trader makes the process very disciplined and eliminates your risk of being led astray in a marketplace filled with questionable alternatives, misleading promotions, and just plain dead ends.

Whether you decide to trade on your own or manage a growing portfolio, educate yourself right here first, and then diversify across different Styles and Methods of trading to be able to ensure your financial well-being.

The goal here at The Diversified Trader is to put you in control of your financial future by giving you the tools to succeed and manage your wealth with confidence.

Nobody’s alike; so, you’ll take what you developed in Planning Basics as your initial Wealth Building Plan to meet your current goals as you’re getting started and wrap it around my picks for the right education and trading services available to establish the foundation for your financial future.

Step Two – Understand the Trading Landscape

Financial education is the key here and is so important to your success but so lacking in most people’s lives. Understanding money and how to use it to grow and keep your wealth is one of the greatest assets you can have in your personal arsenal of knowledge. The basics of money and the prudent management of your financial affairs is something we all need to know and love and will become more important as you accumulate wealth. That knowledge will come as we concentrate on growing your wealth through planning and learning the practical steps you need to take to achieve your goals. To achieve that, you shouldn’t trade anything or invest in anything until you understand the scope of the financial world and exactly what those steps to financial success are and how they work.

Too often we trust the financial services industry because we don’t understand it, and this lack of education becomes the problem that restricts us from gaining the wealth we otherwise could achieve.

At this point, it’s worth mentioning again that discipline is also a key to the success of your Plan. As you know, a major part of my mission is to make sure you make money and never lose under any market situation; so, dedication to your Plan and focusing on its implementation become critical. You’ll be working on your Wealth Building Plan going forward, so don’t worry about learning trading systems right now – you’ll be looking at the bigger picture of how you can meet your overall goals. If you want to trade on your own in the future, the trading systems you learn along the way will fill that need. So, in the spirit of Michael Gerber’s1 great entrepreneurial insight:

What you’ll be doing now is working ON your Wealth Building Plan, not IN the business of trading. Later you’ll work on the Methods you’re going to use to fulfill your Plan, not on the individual trading systems.

Trading systems are only as good as how they were developed and the quality of their performance, so they should never be the focus of any Plan. Many different Systems can fulfill the needs of a particular Method. The trading services you eventually use will have developed their own systems to support their trading style and are usually proprietary to that service. Market conditions change, and individual markets have their own idiosyncrasies; so, you won’t be looking at systems, per se, in developing your Wealth Building Plan. The emphasis will be more on what Styles and Methods work best to fill the needs of your Plan.

Matching your Plan’s Methods with the right Systems will come as you implement your Plan.

Systems are the engines that run the Methods you use and are generally developed by the experts that will make your Plan work. Take a look at Trading Systems – The Difference is Technical to get an overview of the different approaches. The benefit of diversifying across different services and Methods is to take advantage of different Systems developed and managed by different cultures. Don’t confuse trading Methods with trading systems; there can be many different trading systems that apply to one trading Method.

As you Get Started in Step Five, Diversifying across trading Methods and finding the right expertise for each will then become your focus and go a long way to giving you an understanding of the trading landscape.

To get some insight into the inner workings of the trading world, take a look at the categories under THE STYLE and THE VEHICLE in the left sidebar. There you’ll see reviews of the trading Styles and Markets that are available to make your Wealth Building Plans come true. I’ve tried to make the lists as comprehensive as possible, so you can concentrate on building your wealth, knowing all the avenues have been covered. Most of your detailed knowledge and practical application, though, will come from Your Trading Partners that you’ll be using to implement your Plan, along with guidance and resources right here at The Diversified Trader.

For example, with such a variety of services available and new ones coming on the market on a regular basis, it’s natural to be curious about what might be better than what we have. I’ve included an Experimental category under THE METHOD to look at new services or review any non-traditional Vehicles that might come along to satisfy our curiosity and provide a platform for developing new services everybody can use.

Step Three – Know Where You’re Going

This is a good time to review The Rest of My Mission for The Diversified Trader and the basic education and mindset you’ll need before delving into the specifics of how your Wealth Building Plan will work. If you haven’t done so already, read Education – The Path to Independent Wealth Management, which will give you an overview of the basics you’ll need in addition to the regular sequence you followed to get to this point.

With your mindset in the right groove, start by looking again at the categories under THE VEHICLE to get an overview of what’s available to trade and how those Vehicles might fit in with your overall Wealth Building Plan. Albeit preliminary, this review is a first step in building your wealth management plan. The more you learn about the alternatives, the better prepared you’ll be to chart the path to building your wealth. The detail of the Methods you’ll use to achieve your goals will come as you Set the Stage in Step Four below.

Then, with the overview of the various Vehicles in mind, you’ll be combining that knowledge with the education you’ll need in the following Basic Trading Styles as you build your diversified wealth management program. Knowing what’s available increases your awareness of the education you’re getting at every level and how it might apply to your next step.

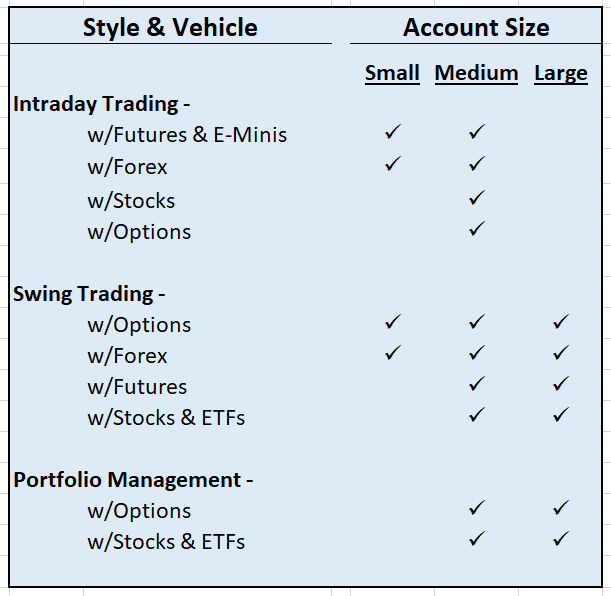

BASIC TRADING STYLES and VEHICLES

by ACCOUNT SIZE

After you’ve learned everything there is to know within The Diversified Trader and armed yourself with what you need to know before you get started, your education in the day-to-day workings of the market will come as you learn the application of the Methods that apply to your Wealth Building Plan through your Trading Partners.

Narrowing the Focus

I’ve mentioned the following subjects elsewhere but thought bringing them together here would help in rounding out your overall understanding of where you’re going; so, here are some notes to clarify the focus of my mission:

- We will be concentrating on finding the expertise within trading Methods using ETFs, Stocks, Options, Futures/E-Minis, and Forex and fitting your plan with the best combination.

- We will not be looking at Mutual Funds, the Fixed Income Markets, Insurance Products (annuities), or any institutional offerings not controlled by you. All the Methods we’ll be using can generate returns that far exceed those produced by the financial services industry with much less overall market risk. The individual has one advantage over the institutional crowd: The ability to be nimble. We can buy and sell our positions without causing a market moving event, where the institutions have to move at a much slower pace due to the large positions they generally have to manage. Forget the statistics in the institutional arena, even though they make up the lion’s share of the market. The only performance statistic that matters is the one in your account.

- We will be focusing on the framework of what’s available in the marketplace to give you an idea of where the limits are and to be able to direct your attention to what really works, so you don’t have to look at everything that comes along and wonder if it’s any good.

- We will not be delving into establishing brokerage accounts and reviewing any legal requirements that surround the world of trading. The broker you use will have all the information you’ll need. If you need help finding a broker, InvestorPlace has a good rundown in their Broker Center, and NerdWallet has a great review of The Best Brokers. You’ll find links in Helpful Trading Sites.

- We will be emphasizing Trading, as I’m sure you’ve gathered, rather than Investing, because the old “buy and hold” philosophy has been proven to be detrimental to your financial health. Even in the longer-term portion of a portfolio, the individual holdings will be “traded” to maximize performance and reduce risk.

The Longer-Term View

Based on your Capital and Experience levels, the eventual Direction you take, the Lifestyle you have or want, and your Risk Tolerance, you’ll need a Short, Medium, and Long-Term strategy to fill out your Diversified Wealth Building Plan. You can diversify within a Style with different Methods, as well as between Styles and Methods. Examples, by account size, of the progression you might take would be:

- You’ve got a Small Account and want to start creating income and building towards being financially secure – a goal you’d love to achieve someday.

Short-Term – Start Swing Trading Options on Stocks and ETFs for growth and income as you’re getting started, then…

Still Short-Term – As your experience grows, add Intraday Trading by learning to trade the E-Mini Futures and/or Forex Pairs to build your account and get to the next level of trading.

Medium-Term – Increase your Swing Trading as your account size grows by using different and more sophisticated Methods, keeping your Intraday Trading for income as a base, then…

Long-Term – Expand into Portfolio Management for longer-term growth when your account size grows to more than you need for the Short and Medium-Term strategies.

- You’re retired or near retirement and only have a Medium Account and need more income to supplement your pension and grow your nest egg.

Short-Term – Start Swing Trading Options on Stocks and ETFs for growth and income while you learn, expand into Swing Trading Forex, then…

Still Short-Term – Add Intraday Trading to the mix by learning to trade E-Mini Futures or Forex until you build your account to a level where Swing Trading Options and Forex gets you to the level of income you want. Intraday Trading becomes optional at this point.

Medium-Term – Diversify Swing Trading Methods by using different Trading Partners to balance your risk and continue growing your account. By now you have a handle on how to manage your account and have the income you want. All you have to do now is keep doing what works.

Long-Term – This is optional, but if you get to the point that you have that extra money beyond current income needs and want to build wealth, expand into Portfolio Management to provide that security you thought you’d never have.

- You have a Large Account and have all your assets in mutual funds, your 401k, or in managed accounts with a large brokerage house. Your account balances have actually gone down in the last year, and you’ve come to realize that you have to do something to stop the bleeding.

Short-Term – Intraday Trading is an option here, if you’re more experienced and want to be more involved, but, for the newer wealth builder, I recommend starting by Swing Trading Options with 5% or less of your assets while you learn, adding Swing Trading Forex as your experience grows, then…

Medium-Term – Increase your Swing Trading for growth and income by using different and more sophisticated Methods, maintaining the 5% maximum exposure.

Long-Term – Expand into Portfolio Management for longer-term growth, slowly replacing your institutional products, so you can minimize market risk and take control of your financial future.

Having the framework to build your Wealth Building Plan, including the Methods to make your Plan work, will give you the confidence that you can finally get control of your financial future. There’s no one answer for everyone, so use what you’ve learned here and look for what makes sense to you from the different Directions I’ve outlined in Planning Basics, and then expand upon that Direction in Step Four below to set the stage to begin your wealth building journey. The avenue you take from there will come from that evaluation of your unique situation, using the wealth building guidelines and education you get right here with The Diversified Trader.

Step Four – Set the Stage

You want to take control of your financial future, and now you know that managing your own wealth is the only way to secure your financial well-being. You also know that you don’t have to “reinvent the wheel” and figure out all the vast amount of knowledge necessary to be successful. All the Education and Training is out there; it’s just a matter of finding the right combination. Right now, setting the stage for how that’s going to happen will give you the confidence you’re going in the right direction.

From what you learned in Planning Basics, you’ve established the starting point and a good foundation for building a solid Wealth Building Plan by:

1) Knowing who you are –

2) Exploring the Direction you want to take –

3) Setting your Initial Goals with an eye on the future –

All those steps are crucial to your success and need to be fulfilled before finding the path to achieve your overall goal. Having a good understanding of these preliminary steps, to the extent you’ve focused on your goals and determined an initial Direction, is so important for getting a good footing on that path to achieving your wealth building dreams. Now, we have to put everything together and work toward a lasting Wealth Building Plan.

Charting the Path

With your preliminary “game plan” in place, you now have the Direction to get you started and an idea of what to build on as you grow in experience. The key is to get started on your initial Direction, so you can learn about the markets and the specific Methods available for your wealth building objectives.

Education comes in many forms, and you’ll have time spent in pure study as you build your knowledge base, but, as I’ve alluded to, your technical knowledge will come through training “on the job”, so to speak, as you learn how to execute the Methods for each part of your Wealth Building Plan. In fact, the path I like most is one that combines education and training in the same program. You should be able to earn while you learn with all Your Trading Partners that meet your needs in your wealth building journey. Your logical progression from there will come into focus as you build on your experience, knowing your Plan is fluid awaiting future knowledge.

Everything can change along the way, but this disciplined approach will get you to your ultimate goal in the shortest period of time, with none of those side trips to trading dead ends.

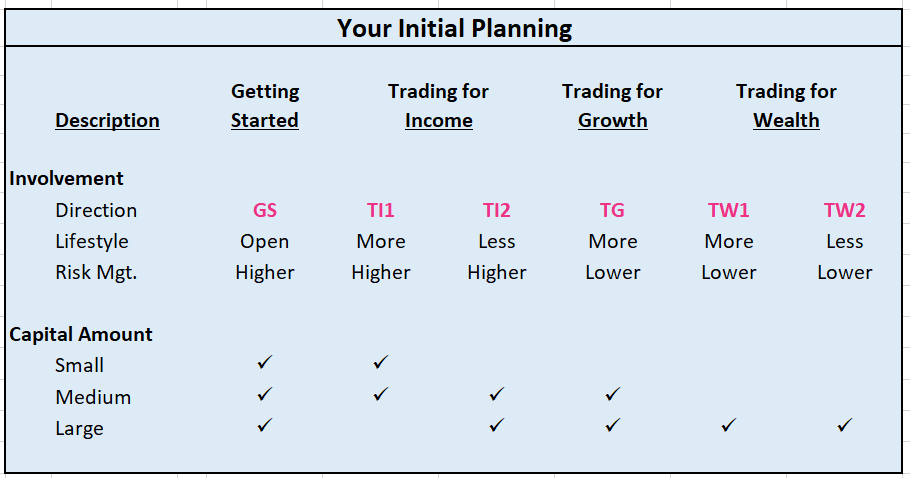

From Planning Basics, I’ve summarized and expanded on this initial planning below to give you a picture of where you’ll be starting and your future Direction choices. No matter what your experience level, everyone will initially be in the Getting Started category, which will give you a good base from which to follow your ultimate Direction. Even if you have experience in other forms of trading and investing, to truly become a self-directed wealth builder you have to get rid of old habits and develop that new mindset to produce success. The best way to do that is to start at the beginning and grow from there – the pieces will fall into place as you diversify and expand your knowledge base.

For the Lifestyle line, I’ve indicated “more” or “less” involvement in the wealth building process under the Direction categories and left the choice “open” under Getting Started, because it’s up to you how much involvement you can put into the process. Risk Management generally varies with the amount of activity within the Method you’re using and goes down as the holding period gets longer.

I’ve used the abbreviations for your wealth building Direction scenarios from Planning Basics to show the group of scenarios at this initial planning stage. To make planning easier, I’ve put everyone at the starting gate, assuming lower experience levels in trading and the marketplace.

As the Direction scenarios suggest, everyone is starting with no prior experience.

The Capital you have to manage can be at any level at this point, and I’ve indicated Capital levels for each scenario to give you an idea where your initial Direction might lead, so you have some insight into your longer-term planning. That doesn’t mean the other categories can’t be mixed into your overall Plan as it develops.

Everything is flexible enough to meet all your needs at every level of your development – That’s more good news.

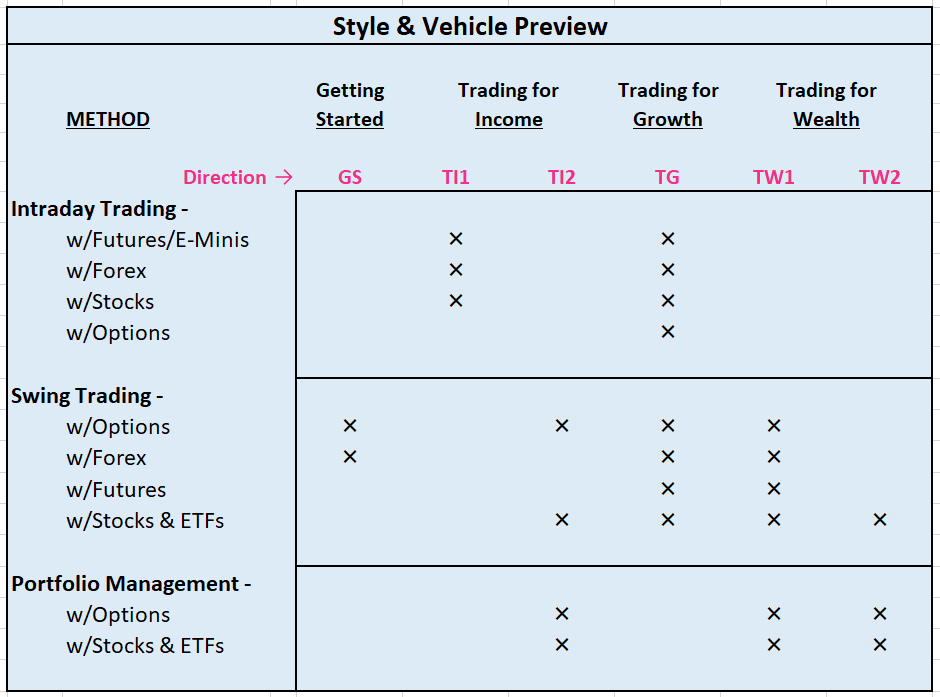

As we get closer to exploring the Methods to use in your Wealth Building Plan, where to start and where to grow, I wanted to combine the Styles and Vehicles you’ll be using with the various Direction scenarios to show where you’ll concentrate your efforts in the Plan you develop over time – in your evolution as a self-directed wealth builder.

You’ll notice that I’ve listed the Vehicles under each Style in order of my preference and then assigned them to the predefined wealth building Direction you may want to take. This defines the universe of Methods that are the most practical for each Direction scenario, if taken alone. As I mentioned earlier, you can always work with different scenarios as your plan develops. Usually, the top two Vehicles under any Style are the best ones to use. I included all the possibilities, so you could see what was available or could be used in specialized situations.

Every “X” on the Style & Vehicle Preview chart above represents the Method that can be used within each Direction.

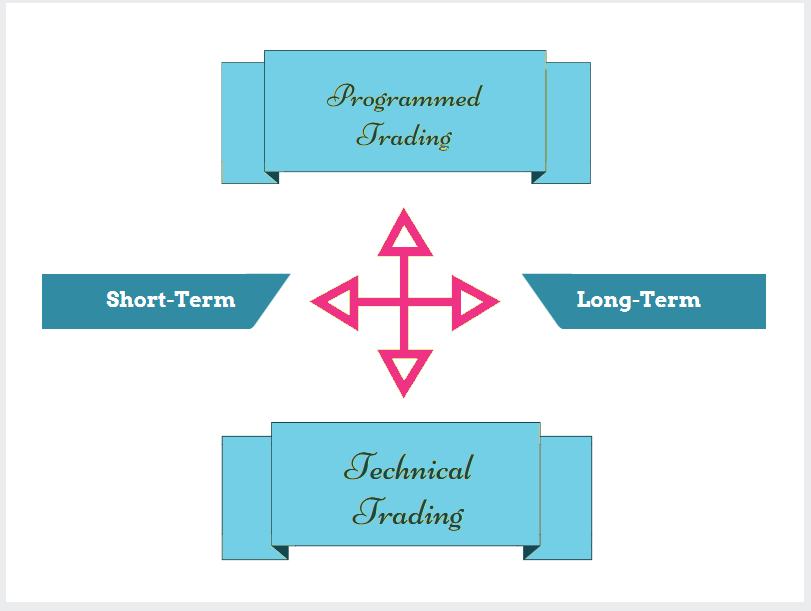

Each Method can have different trading systems to achieve the same end and different approaches depending on the trading service or program you end up using. I categorize trading systems as Programmed or Technical (see Trading Systems – The Difference is Technical) to distinguish between the basic construction of the systems used within any of the services I suggest for your Wealth Building Plan. Each one of your trading partners has its own culture, though, and specializes in their own proprietary systems, but knowing the basic difference in construction allows for a more focused application to your specific needs.

That’s another positive outcome for being diversified by Style and Method – different approaches tend to complement each other and enhance a well-designed wealth management plan.

As the Methods are applied to your Wealth Building Plan, the underlying systems will differ based on your Direction and the need of that part of your Plan. The differences will generally center around whether the trading system is Programmed or Technical and if the Method is Short-Term or Long-Term or somewhere in-between.

The Anatomy of a System

For example, Swing Trading Options under “Trading for Income” will have a much different system and application than under “Trading for Growth”. With the help of The Diversified Trader, you’ll explore all the different Methods you can use, with the right systems, and develop your longer-term wealth building plans along the way. The concept you’ll be following, as you’re getting started wealth building, will be:

Short-Term Trading for Long-Term Growth

Right now, the objective is to get started with your education doing just that in Step Five. Here’s where we take the concept and turn it into reality.

Step Five – Get Started

Building a foundation for long-term success is your initial objective as you begin your wealth building journey, along with cultivating your new mindset of taking control of your financial future. Your involvement over the long-term can be as active as you like, but it should never be passive.

You’re in control now, and only you can chart your course to financial well-being.

This phase of your education will give you the base you need to evaluate and follow any Direction you choose.

Following my theme of being a manager of your wealth and not a trader, the objective is to learn all there is to know about the Methods you’re using (the X’s in the Style & Vehicle Preview chart above) and leave the trading to those who specialize in the systems that meet the needs of your different Methods. Managing, in this context, means knowing what systems to use to meet your goals and managing their application.

Knowing which Trading Partner to use with the right system is a major part of my mission here at The Diversified Trader.

Learning those systems in different applications in the course of getting a broader education on the markets will give you the knowledge to effectively manage your longer-term Wealth Building Plan. It will also put you in a position to evaluate different systems and markets as you develop your knowledge of the art of trading. Having your own benchmarks to evaluate everything that comes along will give you an edge, and a good place to start looking at technical analysis is in my Chart Setup for All Seasons. I emphasize this point, because any system that comes into play relies on good management and knowledge of the markets being traded, and you’ll be in a better position to evaluate that with tools you understand.

The Key is knowing What to Trade When

It was always surprising to me that this concept was so hard to quantify in the marketplace. Everyone had a system and promoted sterling results, without getting down to the execution of trades and how that was supposed to be done. A lot of the systems promoted were based on “back tested” results, so the process of actually making trade entries and exits in the real world was not of any concern. In all my research, it was rare that anyone taught you that very necessary skill of knowing what to trade when.

A central part of my mission is to find Trading Partners that have overcome the “what to trade when” problem and make it an integral part of their education.

Having that skill available at all times is an important part of your wealth building program in all the Methods you use. Being diversified also means getting your knowledge from multiple sources. What you learn here will build that foundation for lasting success. Don’t get frustrated with the education process – concentrate on your learning curve. Too often, when something doesn’t work right away, we tend to want to jump to something else with the false hope that the next new system will finally make us a success. Remember, …

…Only You Can Create Success.

You’ll be using the fluctuations in the markets you’re trading to generate wealth, so it’s important to learn all the underlying forces in the market as you grow and diversify your education and training over different Styles and Methods. This is part of your learning curve, and having patience and focus to thoroughly understand and implement the process will pay dividends over the long run. What you’ve learned here at The Diversified Trader so far will give you a good basis for building your foundation for success. The next step is to learn the process and start building.

Swing Trading Options and Forex

When I talk about learning “the process” and the change in mindset you’ll need to succeed, I’m referring to your personal education in the overall business of self-directed wealth building. At this point, you’ve already built the greater part of the foundation you’ll need to get a good footing in the process of learning how to take control of your financial future.

By studying The Diversified Trader, you’ve seen my mission and understand the importance of your new mindset that trains you to focus your attention on “trading” for long-term growth. You’ve learned about the marketplace and have an executive overview of trading Styles, Vehicles, and Methods, along with the value your Trading Partners add to your diversified Wealth Building Plan. With that foundation, the best way I found to start your wealth building journey is by Swing Trading Options on Stocks and ETFs and Swing Trading Forex Pairs. The breakdown of your first Methods looks like this:

Style – Swing Trading

Vehicles – Options and Forex Pairs

Methods – Swing Trading Options & Swing Trading Forex Pairs

Systems – Programmed and/or Technical

Implementing the Methods then becomes the first step in your wealth building journey. The process is based on a combination of your objectives, level of experience, and the right Trading Partners to provide the education and training in the Getting Started slice of your wealth building pie. Swing Trading will give you the important advantages of this Style of Trading and highlight Options and Forex Pairs as the lead Vehicles. If you haven’t already, start your study of Options by reading Trading With Options and Forex Pairs by reading How to Trade Forex to get the underlying detail.

Where the Methods Start to Make Sense

These two Methods, Swing Trading Options on Stocks & ETFs and Swing Trading Forex Pairs, create the foundation for your Wealth Building Plan, and your progression in the Getting Started phase will follow a logical pattern of education in the basic concepts and gradually bring the complete picture of where you want to go into focus. The steps I like in this section are to:

Lay the Groundwork

Swing Trade Options on Stocks & ETFs with an emphasis on education. No matter what Direction you choose, learning to trade Stocks, ETFs, and Options will give you the basic education you need to function in the markets. This may require “paper trading” for a period of time as you learn the basics of trading with Options and the underlying securities, as well as learning the various applications specific to the system you’re using.

Taking control of The Market, not letting it control you, is a basic philosophy behind my mission to help people take control of their financial future.

Swing Trade Forex Pairs to give you that added dimension and alternative markets to build a strong foundation. How to Trade Forex explains the basics of this market. I like putting Forex trading at the beginning of your learning curve because it can form a basic strategy that will be a part of your Wealth Building Plan for life. Only in strict income scenarios (TI2) and longer-term portfolios (TW2) would Forex strategies not be used.

Starting out Swing Trading Forex Pairs will give you the opportunity to begin with a smaller account or less exposure in your portfolio account, while learning the Methods to form one part of your wealth building foundation. The education and guidance provided by Asia Forex Mentor, including current market intelligence, in the world currency markets is the best I’ve found.

Expand Your Horizons

- Develop your Market Intelligence and establish the flow of information you need to effectively manage your wealth with the help of Your Trading Partners. Daily involvement will keep you abreast of the markets and enhance your reaction time when important events influence your trading. Making understanding the markets you trade and the forces that impact those markets a part of your life will greatly improve your ability to make the right decisions concerning all the pieces of your Wealth Building Plan.

These steps can be taken sequentially or in the order that makes sense to you to get the most out of the process and to “earn while you learn”, so the subsequent steps are paid for out of profits from where you began. With experience, you could incorporate the steps more quickly but learning how to Swing Trade Options on Stocks and ETFs or Swing Trade Forex Pairs first gives you the foundation you need for expanding into all the other Direction scenarios you might want to eventually make a part of your Plan.

Two Exceptions to The Rule

Those of you who want to take one of the Directions with less involvement, Trading primarily for Income (TI2) and less actively Trading for Wealth (TW2), will not need to be concerned with Swing Trading Forex but will emphasize gaining experience with Options, Stocks, and ETFs to form the foundation for these two directions. In these scenarios, your starting point will be different than the norm and can be found in the following sections:

- When you’re Trading for Income (TI2), you’ll concentrate on income generating strategies using Options and managing your longer-term portfolio, so you will be starting by learning Swing Trading Options on Stocks and ETFs for Income with an emphasis on Technical Trading techniques to set the stage for your longer-term Portfolio Management plan.

- In Trading for Wealth (TW2), you’ll be involved in managing longer-term positions with various strategies using ETFs primarily, so your starting point will be learning all about ETFs for longer-term application using Technical Trading techniques. More involvement from your Trading Partners makes this scenario a very viable wealth building plan.

In both scenarios, learning the fundamentals of “trading” and how to navigate the “markets” is still basic knowledge you’ll need to make your Wealth Building Plan a success. Emphasizing your goals in the education and training process will give you the background to manage your financial future.

For All Other Directions

If you don’t know which direction you want to take right now, follow this Getting Started phase to get a good foothold in the process. Swing Trading Options and Swing Trading Forex Pairs give you plenty of opportunity to learn the many facets of trading for your long-term growth. The education you get at this stage is the basis for understanding “trading” and the inner workings of all the different Vehicles and can be tailored to all future Directions you take by adjusting the amount of your activity and focus in specific areas.

Working Together for a Better Life

Let the Journey Begin,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

The Diversified Trader is here to help you build your long-term plan and make it work as you grow in knowledge and experience. The idea here is to build the foundation for your wealth management program and gain the trading experience that will last you a lifetime.

If you’re new here, begin by looking at Education – The Path to Independent Wealth Management, which will give you basic knowledge about how to become an independent wealth builder. Then, learn the best route to making that happen by following the steps outlined in The Diversified Trader – An Overview.

Note from Step Two:

1 The Diversified Trader doesn’t have any connection with Michael Gerber; I just like his philosophy in the entrepreneurial business development arena. If you want to make Trading your business, you might want to read some of his work.