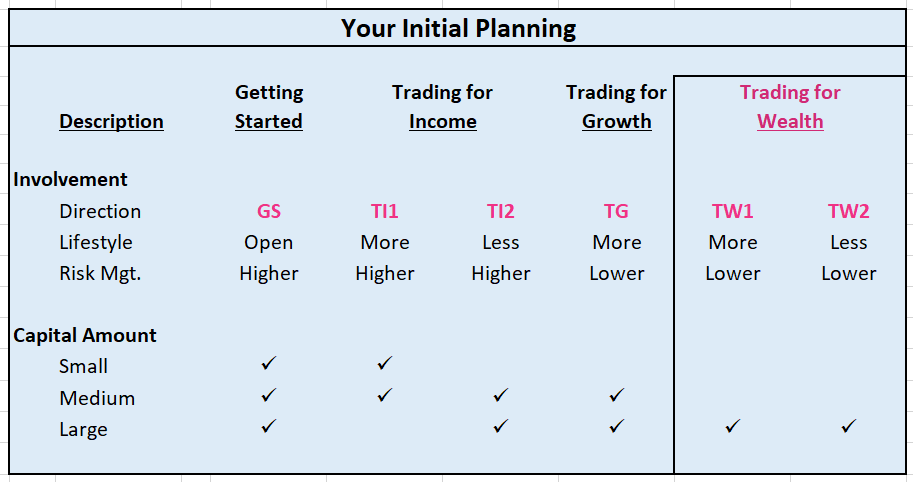

“You have the time and the money and want to manage your wealth to generate better returns than what the financial services industry can muster and gain the confidence that you’ll never lose money to the market again” – TW1.

OR

“Your career or business is doing great, and you know you need a plan to grow and protect your wealth for long-term security” – TW2.

Prescriptions for Building Wealth –

Your malady is being tied to the financial services industry and trying to “invest” in stocks, commodities, and ETFs with advice from the industry itself, putting you in a position of being dependent on their interests and, as a result, being controlled by “the market”.

The initial prescription for overcoming your symptoms is to change your mindset by following what I’ve laid out in The Diversified Trader. As you’ve seen, everything here is designed to prepare you for what I’ve found to be the best path to creating a financial future you can control. When you arrive at this last stage of your wealth building journey or are beginning a longer journey of building wealth, the focus turns to managing “the rest of your money” for long-term wealth.

Anyone with money to invest who lived through the first decade of the new millennium can attest to the unpredictability of the “market” and the insanity of the notion that being fully invested in the stock market at all times pays off in the long run. I was one of those lucky souls and have since wondered out loud how long does “the long run” have to be, especially if you started investing in early 2000. The answer, I found, has two sides to the same story.

The institutional arena is the backbone of the financial markets and is definitely interested in the long-run, but the individual wealth builder can and should be looking at a much shorter time-frame.

Without the proper timing and with your need for money during your lifetime popping up at the most inopportune times, trying to tie your fortunes to the “market” will eventually negatively impact your financial well-being with lower returns or even losses that take years to recover. Trading in the Stock Market will give a look at what “buy and hold” investing might look like, along with the alternative – which looks a lot brighter.

To highlight a core tenet of The Diversified Trader: You’ll be using the fluctuations in the market to be the engine that powers your wealth building program – taking advantage of the market without depending on it.

Long gone will be the days of diversifying by asset class and relying on the prospective fundamentals of specific securities. The futility of “stock picking” will become apparent, along with the dismal track record of those who tout their ability to “pick” the next Amazon or high-flying technology superstar. The only stock picking you’ll be doing is picking securities that fit the criteria you’ve established, or your trading partners have selected, for the list you’ll be using to trade the fluctuations in those specific markets. When Long-Term Wealth Building Matters will give you my definition of Portfolio Management and how to use the concept to your advantage. The fundamentals you’ll be using will change from security specific internal management metrics to suitability for trading in certain market conditions.

Looking at the viability of certain securities to be productive trading vehicles in relation to market conditions is a very different perspective than the traditional view of “investing” and will open up opportunities to grow your account in Bullish, Bearish, and Consolidating markets.

The ability to take advantage of all market cycles, by itself, will compound your returns. In addition, by choosing specific securities to fit this perspective, you’ll have much more productive outcomes. Many of the successful trading services I’ve researched use a limited, qualified list of securities in their programs. Instead of continually looking for stocks with certain fundamental characteristics, you’ll have a well-qualified list of securities that you get to know very well and trade with consistency in all market conditions.

Since the objective is to be trading current movements in the market and finding the right Vehicles for that scenario, you’ll be looking for much different characteristics when choosing candidates for the various parts of your wealth building program than you would in any traditional offering.

Choosing the Right List of Candidates

Examples of these lists of securities are my High Option Volume Stocks and ETFs. Your education and trading services will have their own lists of securities, and you can use those lists or even create your own. You’ve already seen the advantage of using a limited number of symbols when you were learning about Swing Trading Options and Forex. Because you’re trading, you want to have securities that are very liquid, so you can enter and exit your positions very efficiently. To have this advantage, I developed my lists by looking at optionable Stocks and ETFs that have:

- High Volume in the security itself.

- High Option Volume.

- A tight Bid/Ask Spread – In the Stocks, ETFs, and related Options.

- Reasonable Volatility metrics – Implied vs. Historical.

- No obvious flaws in their character.

The fundamentals inherent in any security only come into play when you’re evaluating it for inclusion in one of your lists. The selection process can be as subjective as you want, depending on the purpose for the list and the extent that your objectives play a part in choosing certain securities. Other than that, the emphasis will be on picking securities that have good market action and can be productive in this method of trading. Not all securities react the same way to different market conditions, so having a wide enough selection to take advantage of all market conditions is a major objective of your overall plan.

Even in the long-term portion of your plan, having a well-researched list of securities with the characteristics you want will greatly improve your returns. However, this doesn’t mean having a static list.

The only constant we have is change, so adding to and subtracting from your list to meet your needs is part of a dynamic management process.

With Options or long-term Portfolio Management, ETFs have become favorites with many wealth builders. The wonderful world of Exchange Traded Funds will give you a new perspective on these attractive Vehicles. With a better risk profile than stocks and exposure to many different markets, you may want to include ETFs as an integral part of your long-term portfolio planning.

Once you have your list, current market fundamentals will impact your trading decisions only to the extent that they relate to your chosen securities – greatly increasing your success ratio.

These lists are particularly important in Swing Trading with Options to minimize the amount of analysis you need to produce successful results. Volume, open interest, and Bid/Ask Spreads, not to mention the “Greeks”, all come into play when evaluating Options to trade. The better starting point you have, the better and easier your choices become.

Managing your Wealth Building Plan in this way also eliminates chasing rainbows. When you focus on consistency with a well-qualified list of securities, the resulting compounding far outstrips the gains you might get from “potential” opportunities in the market. You can always add something to your list when it qualifies.

A Word About Screening

The marketplace is filled with advice on how to pick securities for your portfolio, and many are based on using a screening tool of some sort. The traditional approach was basing searches on fundamentals, price levels, price/earnings ratios, and other security specific analytics, but that only generated a generic list of securities with no consideration for current market conditions or how they might perform in various situations. The additional research necessary to weed out the winners made the process very cumbersome.

Screening based on technical analysis criteria and finding securities that fit the mold that I’ve detailed above is the direction I’ve found that creates a much more productive list for achieving growth. For instance, I start a search by finding securities with High Option Volume and work down from there.

Then, when I have my list, I develop screens based on my own technical criteria to find the candidates on that list to either buy or sell in any particular market condition.

This Performance Screening, as I call it, can be done on any time-frame to fit the objective of the Method and System being used. Just being aware of the different screening objectives and applications will put you ahead of the game as you implement your plan. I won’t be covering how to screen at this time, since every service you’ll use has its own lists, and you can always use my lists until you have a need to create your own. Performance Screening techniques can be discussed at that time or, more likely, be developed through your trading partners.

Back to Building Wealth

Along with having your trading partners and their technical expertise to identify the movements within each market, instead of trying to figure out what to trade, you’ll have your list and be able to concentrate on the shorter-term movements and longer-term trends in your chosen markets to consistently achieve market-beating results to ensure a positive growth curve. You’ll be in control of the outcome by…

…Trading for Long-Term Growth.

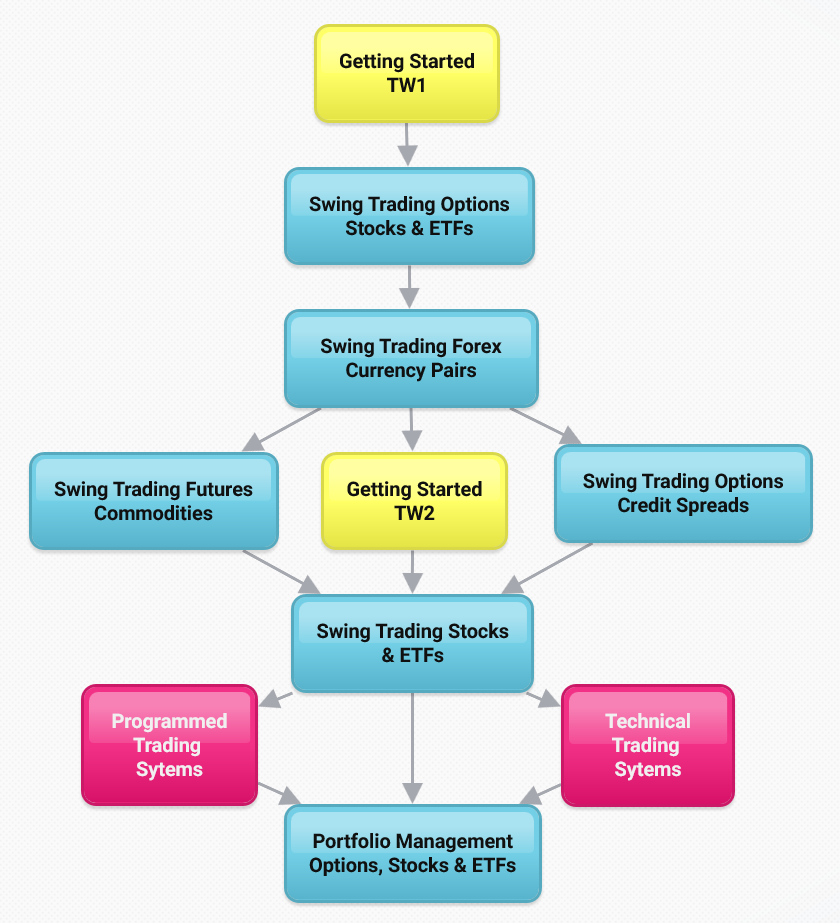

In both Trading for Wealth scenarios, by my definition, you’ll have a Large account balance to begin with and be working on a longer-term horizon. For those of you (TW1) that have been through the Getting Started phase, your basic education and experience with short-term trading sets you up very well to start managing the rest of your money. If you’re just beginning to explore ensuring your financial well-being (TW2), below, in the “Long-Term Wealth Building” section, you can learn to trade Stocks, ETFs, and Futures, including their related Options, for long-term growth and manage your own portfolio to meet all your goals. In either case, you can be as active as you want or structure your Wealth Building Plan to fit your lifestyle without sacrificing the outcome.

Your new mindset puts YOU in charge of Managing your own money.

The benefits of managing your own money to increase your wealth and protect your financial well-being begin with choosing the direction you want to take from everything you’ve learned here at The Diversified Trader.

Knowing the trading landscape and having a firm grip on all its moving parts will give you confidence to start securing your own financial future.

We’ve been exposed to the Institutional Marketplace for far too long and know the risk of leaving your money “invested” with no real control over the outcome. When you learn all about the Methods you’ll be using and apply the right expertise, you’re in control of the outcome – you’ll be managing the Methods you use, and the expertise your Trading Partners bring to the table will provide you with the “application” of the Method in each part of your plan.

Create your Wealth Building Plan, manage the pieces, and use your Trading Partners to make it all work – from education to trading success.

All the education and trading programs you’ll be using here have unique expertise within specific Methods and will be able to fulfill the requirements of certain segments of your Wealth Building Plan. As a result, you’ll be using multiple sources to complete your Plan, which, I’ve found, is the most productive way to smooth out your growth curve and achieve consistent success.

By having complementary trading cultures involved in your Wealth Building Plan, you’ll have many more opportunities to manage your portfolio under changing market conditions.

As you’ve seen getting to this point, after understanding the change in mindset you need to take control of your financial future, the next challenge I faced was to find the right path to success in a marketplace filled with choices but no gatekeeper. The important thing I realized early on out of that research, and want to emphasize here, is that no one service can do everything – the one answer to fulfill all your wealth building goals just doesn’t exist. However, I also found that the expertise already exists in the marketplace for any piece of a wealth building plan anyone could create. The result of that epiphany was the knowledge that all you had to do was to manage the right medley of education and trading services, and the rest would be history. How to do that, obviously, became my mission.

So, to manage the pieces of your overall plan, your job becomes to initially choose the right Methods for your Plan and then find the right expertise for each of its parts.

By having the platform to create your Wealth Building Plan and the ability to look at all the avenues you can take before committing to your chosen path, you put yourself in a position to know where you’re going and how to succeed at controlling your financial future.

From everything you’ve studied up to this point, you know The Diversified Trader is here to help you do just that.

One of the hardest adjustments you must make is to leave behind the traditional view of “investing” and embrace your new mindset, making your wealth building program a habit – an integral part of your life. When you’ve bridged that gap, knowing you can finally take active control of your financial future changes your whole outlook on life. Now, you can chart the path to achieving your wealth building goals based on your own initiative and lifestyle.

The good news is: By choosing your overall Direction, it doesn’t mean you have to follow a predetermined plan.

As you’ve seen in Planning Basics, the variables are too many to put everyone in the same box. Your lifestyle choices, involvement, risk tolerance, experience, and compatibility with different trading Methods and related Systems all come into play when choosing your direction. I’ve structured The Diversified Trader to give you the platform to develop a well-structured plan by starting at the beginning and taking the next logical step along the path until you realize your overall direction. I have also stressed the need to develop your own plan based on your needs, so you have the best path to true success. Your journey continues with exploring the Methods that will get you there.

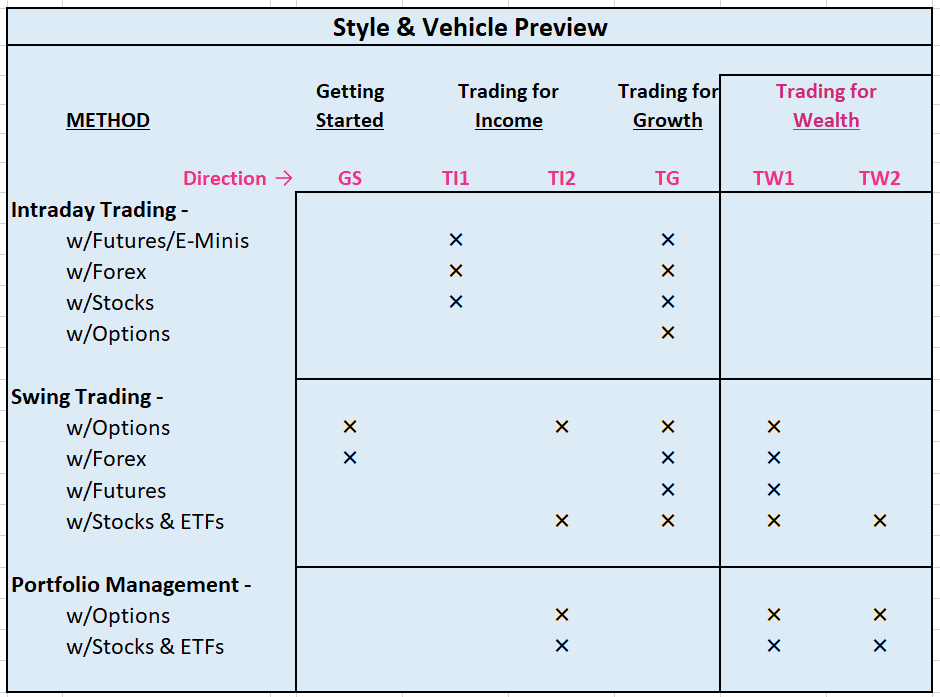

With the whole marketplace of trading services, good and bad, competing for your attention, I’ve found that focusing on these Methods (the X’s in the Style & Vehicle Preview chart above) with a well-developed plan and dedicated partners is the best way to achieve success. By making your Wealth Building Plan work for you with the Systems you’ve chosen for the Methods above, you have the guidance and tools to achieve consistent growth, which leads to the magic of compounding and never having to worry about a fickle market.

More Active Wealth Building (TW1) –

Trading for Wealth, when you have the time and the money, can be very flexible and take many avenues to make it a success. A drawback for many people is the notion that they have to become “traders” and spend their life looking at computer screens. By “managing” your Wealth Building Plan, as we’ve been discussing here, you overcome those obstacles and let your dedicated partners do the trading. By not getting bogged down in developing all the details of trading, you can take advantage of your new mindset and the control you can have over the outcome of your Wealth Building Plan to chart your path to the goals you’ve only dreamed of up to this point.

As in other scenarios, your choice of direction at this stage is determined by how complex a plan you want and how active you want or need to be to achieve your goals.

The advantages you have by managing your Wealth Building Plan are that you can match your needs to the different avenues available to achieve success. You can take the next logical step toward creating your financial future with choices that can range from trading for income, growth, total return, and managing a portfolio for long-term wealth.

By Getting Started and learning all about Swing Trading with Options and Forex, you’ve developed a good foundation for managing your own money and gained a lot of experience with how the markets work. Expanding on this knowledge within your core strategies and adding Swing Trading Futures before developing your longer-term wealth building plan will give you a better starting point and more control over your short-term trading base.

Swing Trading Options, Forex, and Futures

What you’ve learned about your core wealth building Methods (Swing Trading Options & Forex) to this point will form the basis for managing the rest of your money. You’ve probably only used 5% or so of your available capital Swing Trading Options and Forex Pairs and can now expand on that to develop the Methods to grow your wealth. You have your routine established and have had success in growing your account, so you’re at the point where you can take the next step.

It’s important to note: Having success with these two core Methods will get you to managing the rest of your money with relative ease, because, other than having to learn a new system, the process is much the same, only dealing with longer time-frames and different Vehicles.

However, before venturing into building the rest of your wealth, take these steps to cement the foundation you’ve already built. One is to enhance your knowledge of Swing Trading Options and Forex, the second is to add Income generating strategies to the mix, and the third is to learn all about how Futures can form a base for longer-term trading. The best way to do that is to read all about Trading for Income and Trading for Growth and specifically learn about:

- Expanding your knowledge of Swing Trading Options & Forex and then learning how to put it all into practice when you “Energize Your Core Strategies” in the next section.

- Trading for Income by Swing Trading Options with Credit Spreads for a great way to generate steady income and keep earnings coming in during consolidation periods.

- Alternative Markets by Swing Trading Futures to start to balance your Wealth Building Plan as you get ready for longer-term strategies.

When you’ve integrated those concepts into your thinking and brought Swing Trading Options, Forex, and Futures to the point that you’ve made the routine a habit and are growing your account consistently, you’re ready to move on to the next stage and make the rest of your money work for you.

Write Your Own Prescription –

We all have seen the myriad of wealth building offers that circulate in the marketplace and the enticing ads in the media vying for our money. However you managed your money before coming to The Diversified Trader, trying to make sense of the choices was always a hit-or-miss proposition at the best of times. In this last stage of your plan (TW1) or the beginning of a new journey (TW2), the objective is going to be to change the narrative concerning what to do about long-term wealth and how to protect it. Now, the choices become manageable, and you control the outcome within a tight framework. Take a look at the avenues you have as you build toward your ultimate goal of building wealth:

You’ve done most of the preliminary work right here at The Diversified Trader, so you understand the challenges and have a basis for building a longer-term portfolio. The Methods within Portfolio Management will be managed in a similar fashion as in the shorter-term Methods in that you’ll be trading for long-term growth; the variety comes from using different markets within the Style.

At this point, allocation of capital and learning a new system become your primary challenges. The Portfolio Management section of Trading for Income will introduce you to the Systems I like for this part of your Wealth Building Plan.

From here on, the emphasis changes from Short-Term trading to managing the majority of your wealth for long-term growth, with risk management as a top priority.

The importance of being in touch with the market and having great systems in place to control that risk cannot be overstated, even in less active portfolio management. Risk is still as great, only this time it’s harder to identify in a timely manner within the longer time-frames.

Trading your longer-term positions is the answer.

Within the systems you’ll be using, the amount of your involvement can be tailored to your needs, along with the amount of guidance you get from your trading partners. Getting the right balance will depend on your objectives, combined with your lifestyle. In both scenarios (TW1 & TW2), getting started looking at the intermediate-term will set the stage for longer-term portfolio management. As a transition from shorter-term trading (TW1) or the beginning of long-term wealth building (TW2), the experience will give you the opportunity to learn the management systems on a shorter time-frame and with less of your capital at risk.

Swing Trading Stocks & ETFs

– A Prelude to Portfolio Management –

A corollary to Swing Trading Options, Swing Trading Stocks & ETFs looks at the same underlying securities but with a different technical perspective. Higher capital requirements and a longer holding period put the emphasis on growth rather than short-term gains. The list of candidates will be larger due to the longer time-frames inherent in the Method, but the basic structure of the technical approach will be very similar, albeit built for the longer-term objective.

Here, specific screening methods can be used to identify growth prospects that you can use on an ongoing basis to add candidates to your overall list. The tight bid/ask spread preference can be loosened and the volume requirements can be more flexible due to the longer holding period. Your Trading Partners should control the selection through the systems they’re using until you’re advanced enough to manage the list yourself. And, remember, screening is a great way to pick candidates, but your trading system will determine which one to trade.

Systems using Artificial Intelligence (AI) and building Neural Networks to predict the near-term direction of any market are the wave of the future, with their ability to harness vast amounts of data and make sense out of the dynamics influencing those markets.

Indicators of all shapes and sizes are being used to interpret what the market is doing now and has done in the past and are very helpful in analyzing technical behavior and planning specific entry and exit points (see my Chart Setup for All Seasons for an example). The addition of computer programs designed to analyze inter-market relationships and apply Artificial Intelligence to predict potential outcomes takes the tools available to the individual wealth builder to a new level. Combined with “on the ground” human market intelligence, the individual has a much better opportunity to be in control of successfully managing their own money.

As you’ve seen in Trading Systems – The Difference is Technical, I make a distinction between Programmed and Technical systems. Using a Programmed trading system, including those using AI, makes decision-making much easier but requires more “hands-on” management, while Technical systems are much more subjective and have a longer learning curve but generally include more trade management assistance, including recommendations and trading alerts.

Another dimension to consider is the amount of education and guidance available from your trading partners.

The best path for your direction will be determined by balancing the variables to your lifestyle and long-term goals. You could go all the way from managing the systems yourself (TW1) to having your trading partners recommending all the trades (TW2). Those are the extremes, so choosing what’s right for you can fall anywhere in between.

Using different Methods and two or more Trading Partners, as you know, is my definition of being Diversified.

Since the objective is growth, through all market conditions, ETFs are very versatile vehicles to use because of the availability of inverse and leveraged ETFs that cover many different markets. I never liked Shorting Stocks due to the added risk and cumbersome nature of the process, so ETFs fill the bill and allow for taking advantage of Bullish and Bearish markets.

The purpose of Swing Trading Stocks & ETFs, along with long-term Portfolio Management, is to reduce risk and increase returns as compared to what you can get by relying on the financial services industry. By trading this way, you have the added benefit of controlling the outcome.

With well managed exit strategies and “trading” for long-term growth, you should never be in a position to be exposed to a significant momentum shift in the market and lose money.

You’ll be using some of the education and trading services for Swing Trading Stocks and ETFs and for your long-term Portfolio Management, so the transition will only involve expanding the Methods to meet your needs and account size. Adding the systems using AI can only enhance your performance.

Swing Trading Stocks & ETFs is an Intermediate-Term Method and should take up around 20-30% of your account, depending on how active you want to be.

Here, your holding period will range from weeks to a month or two and will act to buffer the normal market swings that affect your long-term portfolio. A part of overall risk management, diversifying your Methods by time-frame will add to your overall return and help energize your growth curve. As an example of this management technique, here’s a chart from the Portfolio Management section of Trading for Income highlighting the blending of Swing and Trend Trading. You can also see the Short-Term Trends developing along a Longer-Term Trend.

Longer-Term Swing vs. Shorter-Term Trend Trading

NASD 100 ETF (QQQ) Weekly Chart

Alternative Avenues

For those of you with experience (TW1), after you’ve established your foundation by Swing Trading the shorter-term Methods, the transition to long-term Portfolio Management can be enhanced by using a combination of the systems you’ve had experience with and incorporating the longer-term Programmed and/or Technical systems to establish the management system you’ll have for the rest of your money. The ongoing market intelligence you get from the shorter-term Methods will definitely help manage your long-term positions in allowing for early-warning alerts when entering and exiting trades. Multiple Time Frame (Fractal) analysis does wonders for timing.

Especially with Swing Trading Stocks & ETFs, using both short and long-term systems to make trades gives you the experience into managing the long end of your Wealth Building Plan. At that point you can decide on the allocation of your capital between systems and purpose. Along with developing the Methods in Trading for Growth, start learning about the new long-term management systems outlined in the Portfolio Management section of Trading for Income.

For those of you just beginning to set up a portfolio (TW2), Swing Trading Stocks & ETFs will be the start of your “trading” education and will eventually lead to managing a long-term portfolio that fits into your lifestyle and meets your goals. With your new mindset firmly in place, use The Diversified Trader as your executive overview of what you need to know before you jump into the world of trading. You’ll get the management basics right, understand the wealth building landscape, and have a reference point as you learn the specifics of how to grow your portfolio.

Depending on how much time you have to devote to your education and training, your path can go from managing your portfolio through Programmed Trading systems to relying on Technical Systems and personal guidance, including trade management recommendations.

It’s important to be compatible with the education and training you get, so the eventual system you use fits in with your capabilities and what you’re comfortable with in your own life. A good place to start is to review the introduction to Portfolio Management in Trading for Income. The basic systems you’ll be using come to life, and the advantages of each will give you a starting point for deciding which one meet your needs.

From that beginning, Swing Trading Stocks & ETFs will give you the experience you need to grow into managing that portion of your wealth dedicated to the long-term.

Portfolio Management

– Options, Stocks, and ETFs –

“Vigilance” is the watchword when it comes to managing the wealth you’ve so carefully accumulated. Here, the right service with the expertise to execute the long-term plan you’ve chosen is the important ingredient to ensure your success.

One of my overriding themes at The Diversified Trader is that you are the manager of your money, and Your Trading Partners are the traders.

The underlying strength of your partners in relation to your portfolio is their constant monitoring of the markets on your behalf. As a result of their vigilance and recommendations, your portfolio will have the attention it needs to achieve a smooth growth curve with the risk management to protect it. If you haven’t done so already, take a look at Your Trading Partners to see what I consider important in their selection.

A note about fees: Since you’re managing your Wealth Building Plan and subscribing to services to give you the knowledge you need to trade each part of your plan, the normal fees used by the financial services industry based on asset values is nonexistent. All your money is in your own account, and you make all the trades, so you’re only paying the transaction fees of your broker and a fixed monthly or yearly subscription to your trading partners. Even with multiple trading partners, your costs are far less than a “fee-based on assets” arrangement and much less than the trial-and-error method so many people end up doing.

As your account grows, your management costs don’t.

This, to me, is one of the great advantages of managing your own money – your returns aren’t watered down by fees getting bigger as you make more money. And, I’m not even talking about hedge funds, where 20% of your profits are taken out along with the fees they already charge.

Trading Systems

In the case of long-term Portfolio Management, the systems appropriate for the Method and time-frame will be different than the shorter-term systems used for Swing Trading Options or Stocks and ETFs. Programmed and Technical Trading systems developed for the longer-term time-frames need to be specifically geared to Portfolio Management to compensate for the “noise” in the market and manage the return on investment (ROI) for the larger commitment of capital. The way you do that is to adjust the internal system parameters for the purpose and objective of your plan.

Programmed Trading Systems use the parameters build by the developer, and the programs are usually structured to allow for you to input your objective and develop a trading system around your choices. The program will have standard systems that have been developed and tested for different market conditions, so it’s just a matter of picking the predefined systems you want to use and building your own portfolio.

It’s fascinating, though, that the programs usually also allow for back testing and adjusting the parameters to create your own system. But, I’ve found, it’s better to rely on the ones that have been developed and tested until you become proficient enough to venture out on your own. With Artificial Intelligence (AI) being introduced into the decision-making process, the development of the systems will become more important and will allow the individual wealth builder to have better control over their objective and not get bogged down in creating systems.

Technical Trading Systems are more subjective and involve interpreting market action in relation to a system made up of indicators and trading plans managed by your trading partners. Here’s where personal guidance and recommendation services can be included. However, it’s difficult to rely on one service and get consistent growth and maintain a high success ratio, so at least two services should be managed for the less active portfolio (TW2), and the combination of different Methods and services can be used by the active wealth builder (TW1).

Research and Development is a continuous process.

In both cases, different services can be integrated into your plan in stages to increasingly improve your results and give you alternative systems to take advantage of different market conditions. Mixing and matching specific expertise from any of Your Trading Partners is the place to start as you develop a basic understanding of all the moving parts that make up the individual wealth management world. The best way to put together your ultimate Wealth Building Plan is in logical steps as your education and training develop. The Diversified Trader is here to do the initial research and development, so you can grow your wealth without the hit-or-miss proposition we had to live with in our previous “investing” life.

Build Your Wealth on a Solid Foundation

Here’s to lasting success,