Swing Trading with Options & Forex

The Center of Your Wealth Building Universe

The Basis for Your Success

With all the different ways people use to make money in the various markets, Swing Trading, in all its configurations, is the single best Style of trading, with the highest probability of success, for the individual wealth builder. Based on using short-term holding periods of more than one day to several days or weeks for any tradeable security, the flexibility and control for the individual wealth builder is the great advantage of the Style. As you start planning your financial future, you’ll find…

… Swing Trading with OPTIONS and Forex Pairs will be the Stars of your Diversified Wealth Building Plan.

The retail trader’s secret weapon against the domination of the institutions trading large blocks of securities, Swing Trading Options on Stocks and ETFs allows the individual to trade the shorter-term fluctuations in the market without interference or competition from the dominant players. The institutions deal in such large positions that they can’t move in and out of the market without causing disruptions to the normal flow of activity. Individual traders don’t have the volume to move the markets and can take advantage of market fluctuations with ease.

Swing Trading Forex Pairs doesn’t have the “dominant player” to deal with, since the foreign currency market as a whole is so large not even the world banks can influence supply and demand. With a limited number of high-volume currency pairs to trade, the analysis and management of this market is very efficient. Low margin requirements, 24-hour trading during the week, and high leverage and liquidity make this market very popular. Adding Swing Trading Forex Pairs to your Wealth Building Plan will add much needed diversity to keep your growth curve consistently rising.

Between the extremes of Day Trading and Trend Trading, Swing Trading transcends market dynamics by allowing the trader to be able to react to changes efficiently and have more control over the outcome of any scenario.

One of the primary advantages of Swing Trading is the higher probability of success for the individual, along with better control over each position relative to the market. Since holding periods can be very flexible, management of various positions over time can be very measured compared with Day Trading, and your positions can be controlled with more accuracy than having to take the market risk inherent in traditional “buy and hold” Investing. Many things could be said for the viability of Swing Trading, but a few I would like to highlight are:

- Swing Trading truly is the ultimate risk management tool in the sense that you can be Long and Short the market and can react to market fluctuations very efficiently and be out of a trade on a technical signal or market moving event that triggers a quick exit. With good risk management comes higher returns, and combined with better control, Swing Trading has the highest success ratio for the retail trader over time.

- There’s no need to analyze the fundamentals relating to any individual security (except for evaluating it for trading suitability) or trying to catch major reversal points or worry about daily gaps and other unexpected events. The analysis centers around price momentum of the markets being traded, not on the fundamental worth of the security.

As we’ll see later, the analysis you use for picking the securities to trade is one of the keys to successful Swing Trading.

- Swing Trading has the greatest potential return with the least amount of daily management, along with being the best Style of trading for the individual to have at the center of their Wealth Building Plan. Longer-term Trend Trading takes much longer to develop, and Day Trading requires more intense management, with a higher degree of complexity. Don’t take this to mean that Swing Trading is somehow easier than other styles; it means you have more control over the outcome of the positions you initiate. Planning your trades and analyzing related market movements become much more structured and allow for more thoughtful management. With the relatively shorter holding periods, related compounding and flexibility of the Style gives you the best chance for higher returns and faster growth to meet your goals.

No matter where your Wealth Building Plan leads you, the education and experience you get with Swing Trading will be with you forever and form the basis of how you build your wealth. The Style is all encompassing, and, as you’ll see coming up, can fill the need for short, intermediate, and longer-term growth.

Swing Trading is your best path to success and should form the core of your Wealth Building Plan.

Swing Trading Methods – Construction and Configuration

By definition, Swing Trading is a Style of trading designed to capture Bullish and Bearish price momentum in any market – it’s the “how”, not the “what”. When you combine a Vehicle and a specific Market with the Style, you have a Method. Any Vehicle can be used – Stocks, ETFs, Options, Futures, and Forex can easily be used to form a Method.

“Swing Trading with Options on Stocks & ETFs” is a Method.

Swing Trading is distinct from Day Trading in that the holding period is at least overnight and can extend out in time from days to weeks as long as the momentum is intact, and it’s different than Trend Trading, which deals with longer-term trends and can encompass multiple momentum shifts.

Start by Choosing the Right Markets for Your Methods.

One of the more important aspects of Swing Trading is to have great symbols to trade. To make a good return, the momentum must be strong enough in the markets you’re trading to produce the productivity you need.

The objective is to take advantage of market fluctuations; so, it’s better to be armed with the best candidates as possible, ones that have the momentum to produce successful trades.

Of all the securities available, look for ones that have good movement (volatility) and liquidity for ease of entering and exiting your positions. Because I like using Options and want flexibility to manage my positions under any circumstance, I look for ETFs, Stocks, and Indexes that are optionable, have weekly options or better, and have good volume in their own right and in their Options.

I’ve included lists of High Option Volume ETFs and High Option Volume Stocks to give you a head start. Futures and Forex already have a limited variety of high-volume symbols that make very good Swing Trading candidates.

You probably won’t need any more symbols than that to build your own viable wealth building program. I’ve found that all the best Trading Partners use a short-list of securities of their own, and you will eventually build your own list to meet the needs of your Plan. Even if you end up doing your own trading using a Partner Program, the lists you create will serve you well.

I’ve tried scanning the market for candidates, even with fairly sophisticated tools, but always had to do so much more research that the effort ended up being counterproductive.

Since the whole idea is to use the fluctuations in the market to make your plan work, I found it’s best to select lists that you can get to know very well and learn individual security’s behavior in all market conditions. This makes trading them much more accurate, and market intelligence becomes more meaningful and useful when focusing on your list. The objective is to take advantage of momentum in either direction, and that can be done with various strategies using these different Methods:

- Swing Trading with Options on Stocks and ETFs is the most popular Method, although any Vehicle with Options available can be used depending on the strategy and your account size. You’re still charting and analyzing the underlying securities, but by using Options you gain the advantages of reduced capital requirements (increased ROI), leverage, and risk management. You can review the advantages of Options in more depth by reading Trading With Options. And, by using the right trade construction, Options can be used in up and down markets, as well as in range bound and choppy situations, with much better control and profit potential than by using the underlying security alone. Options are so versatile, they can be used in most market conditions. Option positions can also be adjusted during the holding period, if the market goes against them, so potential losses can be minimized or even turned into a profit.

- Swing Trading Stocks and ETFs themselves is something that’s very viable for shorter-term trading as well as for the long-term portion of your portfolio, along with the Trend Trading strategies you’re using (see Portfolio Management for a better look at this combination). Your objectives and account size will influence whether this Method will benefit your growth curve.

- Swing Trading Forex Pairs is a very good Method to start your wealth building journey and should be a key part of your overall Wealth Building Plan. Longer-term, serious Forex traders prefer Swing trading to Intraday trading. The built-in leverage and around-the-clock trading make this a very exciting and lucrative market to trade. With the limited number of Major Currency Pairs and high volume Cross Currency Pairs, the amount of analysis and market intelligence you need is also limited, giving you much more control and a favorable success ratio. How to Trade Forex will give you more detail on this very interesting market. For those of you who like a more hands-on approach to your trading, the Forex market is an ideal place to specialize — the starting capital requirements are low and the trading environment more predictable.

- Swing Trading the Futures Markets, in my mind, is a specialized area with its own set of rules and requires a different mindset than trading the other, more traditional markets. High volume Futures are ideal for Day Trading, and I’ve traded E-Mini Index and other popular Futures Contracts intraday, but I have only used Futures ETFs and Options on those ETFs for Swing Trading. Despite my lack of trading experience in the extended futures market, I’ve found there is a robust and different market involving commodity futures, and the Method can be very productive for specialized trading plans. The Futures Market will expand on this market and give you some insight into its application. For a well-rounded Wealth Building Plan, Swing Trading Futures can add a positive dimension with great leverage and profit potential.

In my research to find trading and education products and services, the variety of offerings and extensive education available to the individual trader gives you the opportunity to start small and grow into the trader you want to be or dive right in and trade with your choice of professionals to maximize your potential.

I’ll be adding good candidates to Your Trading Partners menu in the header as I find them to give you a head start.

Swing Trading Strategies – The Application

There are many Swing Trading Strategies you can use with all different Vehicles that will get you started building your wealth. Knowing which strategy to use when is the challenge and leads us back to getting a good education and finding the best strategies to use to achieve your goals. That will be the subject of your Wealth Building Plan and will be determined as you roll out each piece of that puzzle right here with The Diversified Trader.

Making a Trade

When it comes to the application of a Swing Trading strategy, Charts and Technical Analysis will come into play to help you make the actual trades that the strategy requires. The choice of the Chart Structure to use relates to the timeframe and objective of the different parts of your overriding plan. Basically, you’re buying and selling securities between minor and major pivot points for short, intermediate, and longer-term trading strategies. The structure of the chart, though, isn’t as important as the versatility of Swing Trading and its many applications, which are only limited by one’s imagination and the reality of the market.

The art of Swing Trading isn’t in the chart structure as much as it is in the application.

As you get to the application phase of the Swing Trading strategies for Stocks & ETFs you’re using, the Chart structure you end up with will be one that you’ve developed specifically for your Wealth Building Plan. To get you started with the structure I use for Swing Trading Stocks & ETFs and their Options, here are three examples of different time-frame charts to highlight the structure and give you a visual of what will form the basic chart configuration. There are many different chart setups in the market that apply to the various Methods you’ll be using, but I’ll be using my configuration from Chart Setup for All Seasons here to illustrate the three common time intervals.

Short-Term Swing Trading

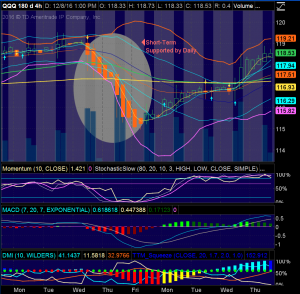

NASD 100 ETF (QQQ) 4 HOUR CHART

Here’s an example of a nice, very short-term Swing Trade that sets-up very well with confirmation on the daily chart below.

Intermediate-Term Swing Trading

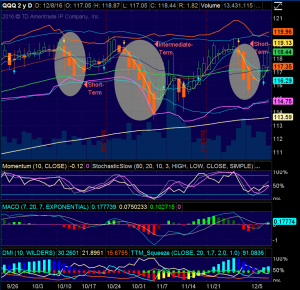

NASD 100 ETF (QQQ) DAILY CHART

You can see the opportunities for Swing Trades even in this range-bound market.

Longer-Term Swing Trading

NASD 100 ETF (QQQ) WEEKLY CHART

Both longer-term Swing Trades can be considered short-term trends or, more accurately, momentum shifts in a longer trend. Your objective will determine how you look at this chart.

The structure of the Charts stays the same for whatever objective is planned; it’s the different applications of the Method, or strategies, that change. As above, the time-frame of the chart will be different for the strategy you’re using, or the definition of each interval, or bar, could be different, but once you have the chart established, the configuration of the strategy can take on any number of different forms.

What to Trade When

The obvious question we all have when it comes to trading is: What to Trade When? Swing Trading doesn’t answer that question, but applying strategies to the Swing Trading Methods gives you the starting point.

Technical Analysis is the primary basis for making decisions for determining “what to trade when” in Swing Trading, taking into consideration any fundamental events that might affect any individual market.

By being diversified in your Swing Trading Strategies, you control the outcome of your overall plan, which gives you the basis to achieve the consistency you need to take control of your financial future.

For now, here are some common Swing Trading strategies you’ll find being used in the marketplace, some of which will come into play when you implement your Wealth Building Plan. When a Swing Trade has been identified – the “what to trade when” – you could trade:

- Long Options (Calls and Puts) in the direction of the momentum (Bullish or Bearish) on Stocks, ETFs, Indexes, or Futures for leverage and risk management. Because long options have a cost that is much less than the underlying security, the potential loss, if the market goes against you, is minimized. Also, the profit potential can approach that of the underlying security, without the corresponding capital outlay, greatly increasing your Return on Capital, making buying options a very efficient strategy.

- Debit Option Spreads in the direction of momentum just as you would do with Long Options, except now you can cover part of the expense by selling an option farther out-of-the-money (OTM) to manage risk and offset the influence of volatility over the life of the trade. They’re great to use with a short-term strategy of capturing frequent market moves, giving you flexibility and other trade management advantages.

- Credit Option Spreads to generate income by taking advantage of time-decay with momentum moving away from your position. They also work very well with strategies designed for range bound markets. Used extensively for income strategies, they need astute analysis of the underlying security to produce consistent results. The Risk/Reward ratio is usually 4:1, so management of these positions is critical for success.

- Forex Pairs and Currency ETFs to take advantage of this alternative market to balance your portfolio and generate short-term income to stabilize your growth curve. How to Trade Forex is a good stating point to learn all about this market.

- Stocks and ETFs for longer-term strategies in the Portfolio Management section of your Wealth Building Plan to complement the more traditional Trend Trading. With the higher capital requirements, trading Stocks and ETFs should be reserved for the larger part of your account, where active management is limited. Otherwise, if you’re using a shorter-term trading plan or have a smaller account, Options can fill the bill for most strategies.

- Futures and Futures ETFs for specialized trading plans dealing with short-term momentum to capitalize on the favorable leverage and the relatively low capital requirements. The Futures Market will give you an expanded view of this market.

The versatility of Swing Trading and the control it gives you over “the market” qualifies the Style to be at the center of your overall Wealth Building Plan. If you haven’t already done so, look at the importance of education in your wealth building journey by studying Education – The Path to Independent Wealth Management.

Then, get started on your wealth building journey by reviewing The Diversified Trader – An Overview to find the right path. From there, the rest of the journey will lead you to your financial future.

Control Your Universe, then ….

Wish Upon a Star,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

For a lot more information dealing with the individual market, Investopedia is a great place for more research.