“Your financial situation isn’t where you’d like it to be, and you want to generate consistent growth to meet your life’s goals and never lose money to the “market” again – you have the will to manage your financial destiny and need to find the way” – TG.

The Great Equalizer – Controlling Your Own Money

There came a time when I realized the financial services industry, backed up by the institutional crowd, would not be able to protect my wealth, much less grow my account on a consistent basis and ensure my financial well-being. As I’ve chronicled throughout The Diversified Trader, I also learned that the marketplace for the individual wealth builder was so fractured and self-serving that finding the path to managing or creating one’s wealth was so confusing that it defied determining a viable direction. So, finding that path became my mission and led me to where you are now and the next step in your wealth building journey.

To Control your money, You need to Manage your money.

To revisit this concept, the individual wealth builder is at such a disadvantage in the marketplace that managing the pieces of a larger wealth building plan and using well-chosen trading expertise within each piece is the only way the individual can hope to overcome the obstacles. And, managing your own money is the only way to ensure your financial future, so putting together a good, diversified plan and managing the pieces becomes the path to success. As an extension of Planning Basics, by “managing” the pieces of your Wealth Building Plan, I’m referring to …

… Managing Your Money by:

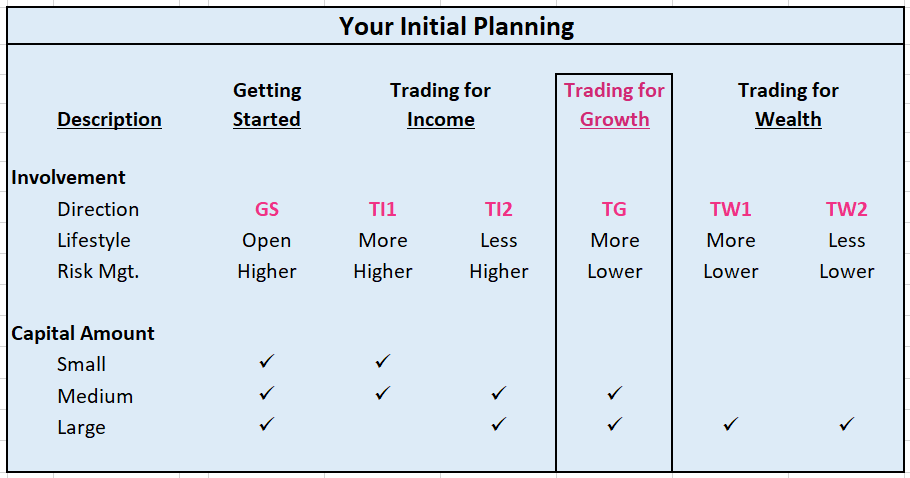

1 – Determining the Direction you want to take,

2 – Creating your Wealth Building Plan,

3 – Learning about all the Methods you’ll be using,

4 – Finding the Right Expertise within each Method, and then…

5 – Using that expertise to execute each part of your Plan.

You’ve learned in the Getting Started phase about the productivity of using different trading cultures and systems, and now the process becomes to expand on that knowledge and increase your degree of difficulty for better management of the capital you have.

When you’re at this stage, by my definition, you’ll be working with a Medium account balance and have current income from other sources, so your wealth building options grow and allow for greater flexibility. Programmed and Technical Trading have been introduced to your knowledge base, and now it’s only a matter of increasing your range of opportunities. The only other decision you’ll have to make is how active do you want or need to be to achieve your goals.

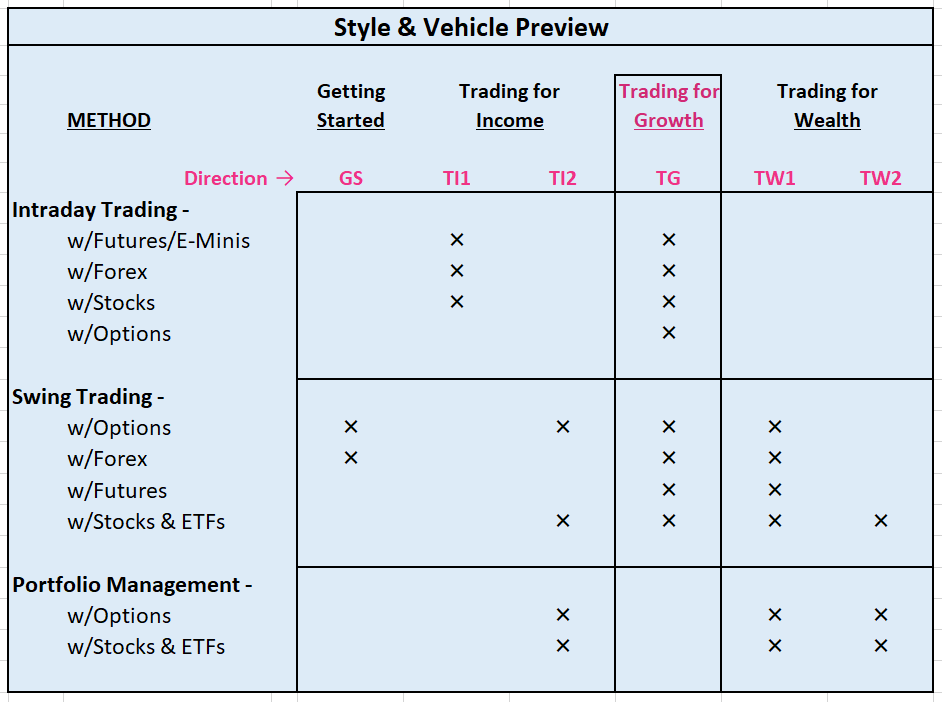

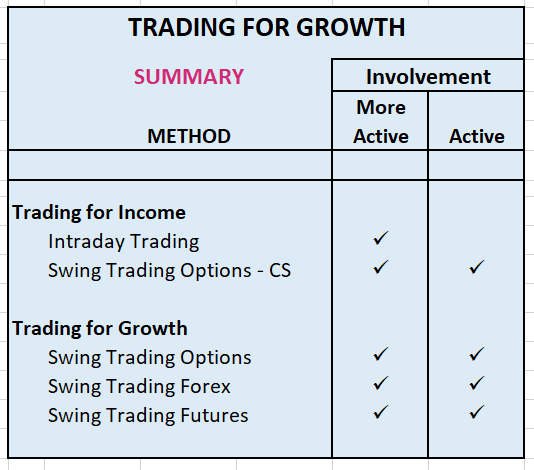

Trading for Growth is the most versatile direction to take at this stage in your wealth building journey, because you have the flexibility to include Income generating strategies along with your growth objectives.

Intraday Trading and Option Spread techniques can be used in conjunction with your Swing Trading programs.

This gives you various choices to fit your needs and lifestyle. You have a large enough account at this stage to take advantage of more sophisticated strategies and to deal with larger or more varied positions for greater returns.

The experience you’ve gained by Swing Trading Options and Forex Pairs, along with your education in how to trade the markets, puts you in a position to take a variety of paths to achieving financial well-being. Basically, you could be working, running your own business, or retired and manage a wealth building plan that gives you the income and growth you need to fulfill your goals.

When You’re Working

When you don’t have free time during market hours but still have time to be active in managing your money, what you learned in the Getting Started phase about Swing Trading Options on Stocks and ETFs and Swing Trading Forex Pairs is your foundation for growing your account. You’ve already incorporated those money management routines into your life, so the transition to building on that start is only a matter of gaining greater sophistication and leverage. Some of the additions you could make here are to:

- Simply scale your position size as your account value grows to be in line with your risk management guidelines. Swing Trading Options and Forex Pairs can be all you need to grow your account. Your Trading Partners already have the education and expertise you’ll need to expand your horizons in those two Methods.

Following the rest of the suggestions will only make your wealth building better and can be phased in as your time and knowledge permit.

- Increase the number of markets you’re trading to give you balance and greater consistency. As you’ve seen, dealing with a defined list of symbols is the most productive and manageable trading plan, so expanding your knowledge within the list will give you more opportunities. Take a look at my High Option Volume Stocks and ETFs for additional candidates.

- Continue your education by learning more about Technical Trading techniques to increase the productivity of your trading for longer-term growth. Expanding your experience with Options, Forex, and the underlying securities can give you the knowledge you need to grow your account to the next level.

- Establish income generating strategies by adding Option Credit Spreads to the mix as your confidence grows (see TI2). Other combinations and techniques can be added as the need arises.

- Learn to Swing Trade Futures contracts to diversify your Methods when your account size and risk management guidelines allow. The alternative markets provide balance to your portfolio and help you transition to managing a larger account. The Futures Market will give you the background you need to understand the various Markets in this Method.

- Swing Trade Stocks & ETFs as your account gets larger. The object is to have consistent income and growth with adequate risk management, so the added balance you get by trading the stocks and ETFs themselves with the right guidance from your Trading Partners will provide that base you can use to smooth out your growth curve.

When You’re Retired

When you’re available during market hours and have the desire to devote more time to your wealth building efforts, your opportunities are limited only by your account size and how much you want to do. By being available to personally manage your various positions at all times, the advantages you have beyond the basics you learned in Getting Started and the enhancements you can make right away by following the recommendations above are that you can:

- Have more positions active at any one time and trade on a higher frequency to greatly accelerate returns. The advantage you have is being able to trade for Income and, at the same time, have more Growth strategies working to the benefit of your overall Wealth Building Plan.

- Do research into more sophisticated trading programs that will enhance your current trading results and get you ready for the longer-term part of your plan. The ideas in Portfolio Management for TI2 can be applied to your shorter-term strategies and set the stage for future growth. This will give you more control over the transition to make sure you never lose money to the market again.

- Increase your use and knowledge of Options and Forex Pairs as you learn more about Technical Trading. With more advanced guidance from your Trading Partners, you can improve the management of all your Option positions to take your performance to the next level.

- Add Intraday Trading with Stocks & ETFs, Forex Pairs, or Futures/E-Minis for consistent income and to balance your wealth building results until you grow your account to a level where Swing Trading is all you need to get to the next level where you can be Trading for Wealth.

Intraday Trading (TI1) is one of those skills that gives you control over your “flow of funds” and can enhance your longer-term trading programs by giving you market intelligence you wouldn’t have otherwise. Swing Trading can and will run into periods of market consolidation and choppiness, so having Intraday Trading as part of your Wealth Building Plan will give you the advantage of generating income during those periods to also help smooth out your growth curve during market volatility.

Note: Option Spread strategies using weekly options for generating short-term income can also be used during periods of market consolidation.

You can use Intraday Trading on a regular basis or as the need arises, but having the knowledge and systems to make it work will put you into a better position to manage your wealth, especially in the initial stages where you need income to form a good base for growing your account.

As you review and implement the strategies available, you’ll be able to decide which direction you want to take for generating income – Intraday Trading, Swing Trading Option Credit Spreads, or both. This way, you have the flexibility to maximize your wealth building efforts within your lifestyle. Along with Intraday Trading, Swing Trading income generating strategies can enhance any plan and establish a base for your long-term planning. If you’re a more active wealth builder, having multiple income strategies will be an integral part of your overall plan.

From Short-Term Trading to Trend Trading, Your Trading Partners can give you the direction you need to expand beyond the basics.

The Great Divide – How to Manage Your Money

There are many avenues you can take when it comes to managing your own money. Deciding on the route that’s best for you is part of your overall planning process. I’ve structured The Diversified Trader to give you the knowledge you need to make the right choice, so you can develop your plan a step at a time as you grow toward your ultimate goal.

Making an informed decision is what it’s all about.

You’ve learned the basics by Getting Started and have come a long way in the beginning stages of wealth building by growing your experience and knowledge, along with your account, to the point where you can look to the future. Now, you want to take your journey to the next level and form the next steps in the direction that fits your personality and the lifestyle you have or want. At this point, you’re fairly well along the path you want to take, and your goals are more in focus. Your next decision is to pick the right avenue for the rest of your Wealth Building Plan to meet those goals.

Wherever you are on the Involvement pendulum, your next step is an extension of what you’ve learned so far and where you want to go in the future – filling in the rest of your Wealth Building Plan. As these opportunities become visible, your Plan takes on a new character with more concrete goals along the path to your financial future. Here are the avenues you can take to complete this stage of your Plan, no matter how you want to build your wealth:

TRADING FOR INCOME

Intraday Trading

At this stage in your journey, having Intraday Trading in your arsenal of wealth building Styles really gives you an advantage in managing your short-term income producing strategies. As the markets get more volatile and unpredictable, the risk to your Swing Trading strategies goes up because of the longer holding period. Intraday Trading is available in any market condition, so it can be used to generate income on a regular basis and to buffer or replace your other short-term positions in those times of marker turmoil. Day Trading Stocks and Intraday Trading Techniques go into more depth and will get you started incorporating either Style into your Plans.

Swing Trading Option Spreads

For changing market conditions or for longer-term income strategies, Option Spreads add a vital piece to the puzzle of maintaining consistency in all market situations. This is where Technical Trading techniques come into play, because you’ll need the individual guidance that comes from knowing market conditions and the art of managing positions for maximum return. Done right, Swing Trading Option Credit Spreads for income can be a staple of any Wealth Building Plan. See how it’s done in the Swing Trading Option Spreads section of Trading for Income (TI2).

TRADING FOR GROWTH

Swing Trading Options, Forex Pairs, and Stocks & ETFs

Once you’ve completed the Getting Started phase and have a basic education in Options and Forex trading and experience with the underlying markets, expanding your opportunities in both arenas and adding Swing Trading Stocks & ETFs becomes the logical next step in growing your wealth. The Methods are core ingredients in many Wealth Building Plans, and taking advantage of their many facets will give you greater control and enhance your level of consistency. Here’s where learning more about Technical Trading and working with those who’ve made the fine art of trading these Methods their business becomes important.

Technical Trading includes Market Intelligence, as you’ve seen when you were Getting Started, and its application gives you the edge you need to fully understand the marketplace and react to every change affecting your wealth building life. Knowing what works and what doesn’t is invaluable in judging the effectiveness of the Methods you’re using to achieve your goals.

Swing Trading Options and Swing Trading Forex Pairs are the foundation of your Wealth Building Plan, and the basis for your trading are the underlying markets. Getting a firm grasp of the markets you’re trading is the cornerstone of that foundation you’ve built, and Technical Trading techniques and education are the building blocks of that knowledge.

The Next Step

The next step is to increase your sophistication with using Options, gain market knowledge of the currencies you trade, and work with the underlying markets to improve the application of your Swing Trading strategies. You can make Swing Trading Options, Swing Trading Stocks & ETFs, and Swing Trading Forex Pairs work to your advantage by:

- Greatly increasing the effectiveness of using Options by expanding and applying your knowledge of different techniques and combinations to take advantage of ever-changing market conditions. Knowing when to use which Option strategy in what situation is a key ingredient of the knowledge you gain through Technical studies and related education and guidance. As an example, the Debit Spread can be used in certain situations to reduce the risk of purely directional trades. Also, your income generating strategy, Swing Trading Options with Credit Spreads, in the Trading for Income (TI2) section can be improved by using Options in different combinations, including Iron Condors, Calendar and Diagonal Spreads, and Butterflies. The ability to make adjustments to trades before the market moves against your position is an essential talent to develop to maintain your productivity over time.

- Expanding your work with Stocks & ETFs to gain the knowledge you need to swing trade those markets as your account size grows to the point where the Method can provide that all important base to balance your portfolio.

- Giving more emphasis to the analysis of the Forex markets to increase the productivity of your related Programmed Trading system to add more opportunities for greater growth. Having live, daily analysis to guide your Forex trading gives you the edge in evaluating the signals you get from the trading system you’re using to make better trades. This more specifically applies to Swing Trading Forex Pairs but can also enhance your Intraday Trading of the Forex markets when Trading for Income. How to Trade Forex is a good place to reference the structure of the Forex market.

Learning more about Technical Trading and the tools and strategies you need will keep you ahead of the market, help you make better trades, and protect you from the very fickle markets. The marketplace is filled with a vast array of different opinions and strategies that are beyond mind-boggling, to say the least, so keeping your focus on the ones that matter is your ticket to success in the long run.

Your Trading Partners in each Method will dictate what tools and strategies you use, and it’s important to learn what they mean and use them to your advantage. From my Chart Setup for All Seasons to the proprietary systems of your Trading Partners, Technical Trading will complete your education cycle in this phase and put you in a much better position to manage your Wealth Building Plan.

Swing Trading Futures

When you grow into or already have a Medium to Large account balance (more than $100k), I like to introduce Swing Trading Commodity and Financial Futures (Treasuries and Currencies, not Stock Market Index Futures). I make the qualification because I’ve found the volatility in the equities market makes Stock Market Index Futures more productive for Intraday Trading. You’ll need good expertise and guidance in all the Futures markets, but having the alternative markets to balance your portfolio is well worth the effort to make the Method part of your plan.

The advantages of Futures outlined in The Futures Market, along with the limited number of popular markets to trade, make Futures an ideal vehicle to use before getting into the longer-term strategies you’ll use when your account grows closer to the Large category and you start Trading for Wealth. Even then, Swing Trading Futures can remain a part of your larger wealth building plan and provide the transition to longer-term Portfolio Management.

We’ll see how all the pieces fit together in the next section.

The Great Reward – Making Your Money Work for You

Not all Wealth Building Plans are created in the same mold, so the path to your financial future has its unique direction. Here’s where your Plan becomes your own. With your starting point being Swing Trading Options on Stocks & ETFs and Swing Trading Forex Pairs, further wealth building should follow your experience level, account size, and your ultimate objectives. The way I’ve structured The Diversified Trader, your next step should be an obvious extension of your planning and experience to this point in your wealth building journey. Many avenues open up after you have the basics of trading and know where to look for the expertise you need to make every piece of your plan work. Following the alternative avenues below will get you involved at the level that best fits your objectives and your overall wealth building plan.

Your Wealth Building Plan

Alternative Avenues for Growth

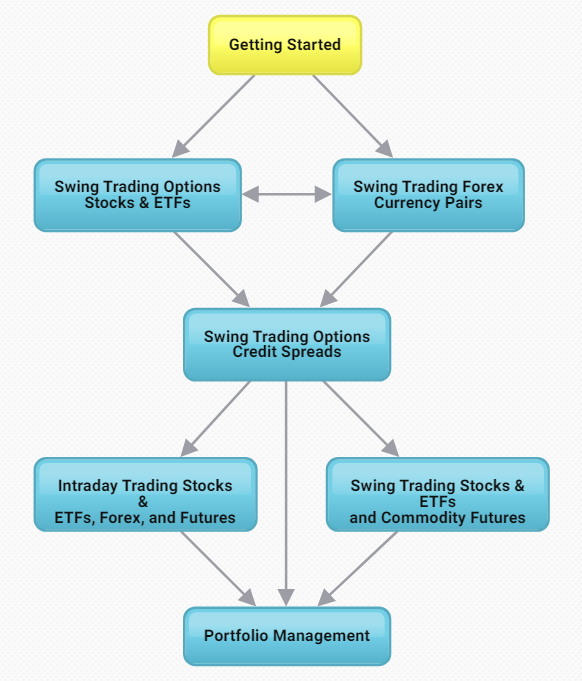

Find the avenue that best fits your vision of where you want to go and map it out – make your own flow chart. Any combination will work, and putting together the right one for you is a major step forward in nailing down the direction you want to take. I put Portfolio Management at the end of all the Growth scenarios below just to show the logical future avenue you’ll have as your account grows beyond the needs of your shorter-term trading. In ascending order of involvement, I put together the following sample avenues that will give you a framework to choose the direction you want that will get you to where you want to be:

- Active – ♦Swing Trading Options and/or Equities – Stocks & ETFs ⇒ Swing Trading Options – Credit Spreads ⇒ Portfolio Management♦ With a little more involvement, this avenue gives you more flexibility and keeps you focused on the equity markets with growth potential by adding more ETFs to capture long and short market moves.

- Active – ♦Swing Trading Options and/or Equities – Stocks & ETFs ⇒ Swing Trading Forex – Currency Pairs ⇒ Swing Trading Options – Credit Spreads ⇒ Portfolio Management♦ Without being available during market hours, this avenue provides for a well-rounded management routine for those of you who have the time. With Forex Trading in the mix, managing your growth curve for consistency becomes a lot more productive.

- More Active – ♦Swing Trading Options and/or Equities – Stocks & ETFs ⇒ Swing Trading Forex – Currency Pairs ⇒ Swing Trading Options – Credit Spreads ⇒ Swing Trading Futures – Commodities ⇒ Portfolio Management♦ Here, the emphasis is on Swing Trading Futures and not having to deal with Intraday Trading. The analysis and trade execution process is much more measured, and, with good management, leads to higher success ratios, albeit over a longer time frame.

- More Active – ♦Swing Trading Options and/ or Equities – Stocks & ETFs ⇒ Swing Trading Forex – Currency Pairs ⇒ Swing Trading Options – Credit Spreads ⇒ Intraday Trading – Equities, Forex, or Futures ⇒ Portfolio Management♦ The difference here is in the time you have during market hours to manage your plan. With time available, being able to concentrate on Intraday Trading at an advanced level greatly enhances your income generating capability.

If you’re super aggressive and have the time and money, you could use all the available avenues to further your well-being, but the more practical approach is to find the combination you’re comfortable managing and develop a routine that produces consistent results. Besides developing your plan sequentially, knowing what’s the most productive scenario for your situation will give you the most satisfying outcome. Pick your direction, expand your knowledge, and all the pieces will come together to form your real plan for building wealth.

Where Your Money Goes to Work for You

This is the “How To” section for everything discussed above. Not all plans have to be involved with every available Method, and an incremental approach to building your wealth is the most logical one to take. This way you can control your involvement and balance your goals with your lifestyle.

Your experience Swing Trading Options and/or Forex Pairs when you were Getting Started is an ideal base for filling out your Wealth Building Plan, no matter where your plan goes from here. It’s very important to develop your plan sequentially and have a firm understanding of each step along the way as you build to your ultimate wealth building goal.

From all the avenues available, pick the one you want to follow and fill in the next step in your plan.

Energize Your Core Strategies

Learn more about Technical Trading and fine-tune the market intelligence network you’ve established. This will allow you to incorporate expanded Options techniques to improve your Swing Trading and manage market conditions affecting the underlying security.

Improve your Forex analysis to complement the trading system you’re already using. In the interest of diversifying the trading cultures within the Method, getting more fundamental analysis and input puts you in a much better position to manage this part of your plan.

Add a Core Income Strategy

Swing Trade Weekly Options using Credit Spreads to establish consistent income generating strategies. This applies to all activity levels, along with Credit Spreads becoming the primary income strategy for the Less Active (TI2) scenario. Depending on what markets you’re trading, the variety of Options expiration dates gives you various timeframes (other than weekly) to work with. Trading for Income (TI2) will get you on the road to providing a steady income with the tools to gain the consistency you need.

Take Your Plan to the Next Level

Intraday Trading Stocks & ETFs, Forex, or Futures for income and to compensate for market conditions that affect other Methods. This is for the More Active scenario, and the amount of emphasis you put on this Method will determine the direction of the rest of your overall plan. Trading for Income (TI1) shines the light on this Method.

Swing Trading Commodity and Financial Futures for the intermediate-term portion of your plan. By the nature of the commodity and financial markets, fundamental factors have a great deal of influence on those markets on a very short-term basis, so understanding the markets you’re trading becomes an important part of being successful. The Futures Market will get you on the right track.

Look to the Long-Term

Begin introducing Long-Term Portfolio Management into the mix. All the Technical Trading and Investing programs developed by Chris Vermeulen at Technical Traders apply equally to achieving the goal of conservative growth. Primarily for longer-term Trend Trading, the programs have the advantage of being able to be applied to Swing Trading for shorter-term, intermediate growth positions, so they can be looked at by all activity levels. Start to look to the future and to that day when you can be Trading for Wealth.

Building Wealth with a Purpose

Let Your Journey Continue,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com