Portfolio Management –

When Long-Term Wealth Matters –

Portfolio management refers, in the generic sense, to managing whatever money you have available for trading and investing; so, any assets or trading vehicles you have in your account would qualify to be included in the definition. However, that’s too general a concept for what I want to do in creating a good plan for managing your wealth; so,…

… I’m including Portfolio Management as a Style of Trading to have a place to work on building lasting wealth through “trading” for long-term growth — representing the long-term portion of your Wealth Building Plan.

Intraday and Swing Trading are centered around more short-term market moves for the short and medium-term parts of your Plan, and I wanted to highlight an area that’s been in the traditional realm historically but needs to come out in the open as a viable Style of “trading” to meet your long-term goals, distinct from the other Styles of trading we’ll be using to grow your wealth. Here’s where we will be concentrating on Trend Trading, Long and Short, to take advantage of the longer-term moves in the markets.

Don’t confuse this with “Position Trading”, or Investing, which generally refers to equities and their fundamental worth over a very long timeframe. To be successful, rather than trying to “Invest” in the right security at the right time, which puts you squarely in the “market” with all the risks that come with it, you’re better off taking advantage of market fluctuations by “trading” the trends for long-term growth.

By “trading” the trends, you increase your efficiency and eliminate the risk of being at the mercy of the market.

Where the financial services industry wants you to diversify your portfolio between Stocks, Bonds, Commodities, and Cash and “hope” those markets cooperate, as self-directed wealth builders, you’ll want to use the trends in chosen markets to gain the advantage and grow your portfolio consistently, along with managing market risk, so you never lose money to the market over time.

Turning the tables like this puts you in control of your long-term financial goals and gives you the peace of mind knowing you have the right Methods to make all your goals come true.

Concentrating on market trends and finding the right vehicle at the right time for any market situation holds the key to being successful at my version of Portfolio Management. Since trends develop in different markets at different times and only happen 20% of the time or less in any market, longer-term Swing Trading should be included in the mix to get the productivity you want. Trend Trading and Swing Trading start at the same place; so, Swing Trading until a trend develops gives you the versatility to take advantage of a Bull or Bear Trend whenever it occurs. Knowing the difference between the two styles and applying them at the right time, with the right Vehicle, becomes your goal.

Getting the right start here at The Diversified Trader to solve all those challenges gets you to your goal in the shortest period of time — with the best results.

With my concept of Portfolio Management in mind, concentrating on the long-term piece of the puzzle, the objective is to spend less time trading this section and more on timing and selecting the right vehicles. Keep in mind that some of you are going to be using these longer-term strategies along with your short and medium-term Methods; so, a lot of the market analysis and day to day intelligence you get from these sources can be used as the basis for your long-term trades. I want to emphasize Trading for Long-Term Growth to distinguish the long-term section of your Wealth Building Plan from the traditional “buy and hold” stock buying plans put forth by the financial services industry.

Working with the trends in the market, rather than the fundamentals of certain assets, puts you in a much better position to grow your wealth consistently and with less risk – taking “hope” out of the equation.

Portfolio Management then becomes trading for wealth over a longer time horizon than your Short and Medium-Term strategies, which were meant to get you started building your wealth. The combination of short and long-term strategies is very powerful, and, by using different Methods, with the expertise to match, for each section of your Wealth Building Plan, you gain the diversification of trading cultures that can be just the synergy you need for long-term success.

However, everyone has different goals and level of involvement in the wealth building process; so, my concept of Portfolio Management applies more to the Wealth Building Directions in Trading for Income (TI2) and Trading for Wealth (TW1 & TW2). The Direction you take here might look something like one of these choices:

- Manage your Portfolio to grow your medium account balance and generate Income beyond what the financial services industry can produce (TI2). This Direction is ideal for those of you who don’t want to spend a lot of time managing your portfolio but need solid guidance to protect and grow your wealth. The combination of using selected ETFs, trading with The Market, and generating Income with monthly Options is the right recipe for that scenario.

- Manage your Long-Term Portfolio along with your short and medium-term Methods through Trading Partners picked for each stage of your wealth building plan (TW1). Here, the process of transitioning to the longer-term part of your wealth building plan should be very smooth after your experience and education with your Trading Partners that got you to this point. We’re still looking at market fluctuations to be the basis for growing your account, and the addition of the longer-term view will give you the direction you need.

- Manage your total Portfolio as your Long-Term Wealth Building Plan (TW2) . This scenario is appropriate when you have a medium-to-large account and want returns that far outstrip those you can get in the traditional marketplace, but you don’t want to actively trade shorter-term strategies. You can do all your training in conjunction with developing your Long-Term Methods and establishing your management plan. This direction is ideal for using portfolio management expertise from your trading partner.

The End Result

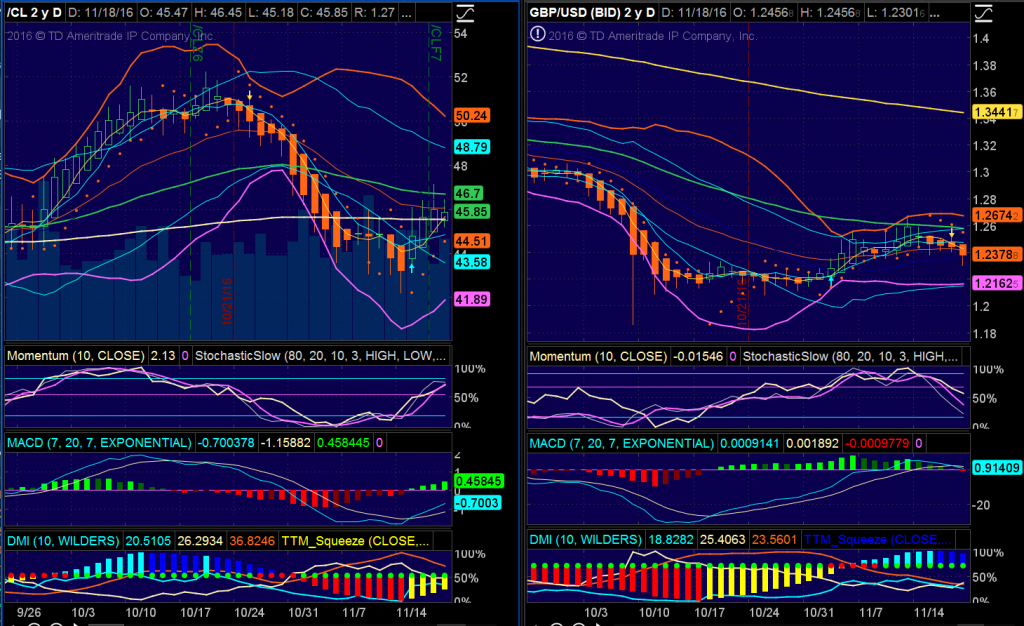

Along with the Trading Partners’ systems you’re relying on, having your own chart setup is always a good idea to evaluate and compare signals on any of your positions. Take a look at four alternatives using my chart settings to get a sampling of what the universe might look like.

Stocks and ETFs

Commodities and Foreign Exchange

The ability to trade various markets gives you the flexibility to be positioned for growth to a much higher degree. Adding Options to the mix can multiply your returns by adding leverage, generating Income, or giving you greater certainty by managing risk. And don’t forget about leveraged ETFs for better returns.

This stage of your Wealth Building Plan will control the largest share of your wealth after you’ve developed your short and medium-term programs, if that’s how you arrived at this point. The line between longer-term swing trading and trend trading for long-term growth gets blurred by what direction you take; so, the portion allocated to this stage can run as high as 90% for larger accounts (100% for scenario 3 above) and lower percentages as your account grows. Your situation will dictate this allocation as your overall trading plan develops.

Trading for Long-Term Growth

To Your Long-Term Success,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

For a lot more information dealing with the individual market, Investopedia is a great place for more research.

If you’re new to all this, have a look at Education – The Path to Independent Wealth Management to appreciate the importance of getting the right education before you start the steps I’ve laid out to get you to your financial future. Then, review The Diversified Trader – An Overview to shine a light on how to build that long-term portfolio you can manage.