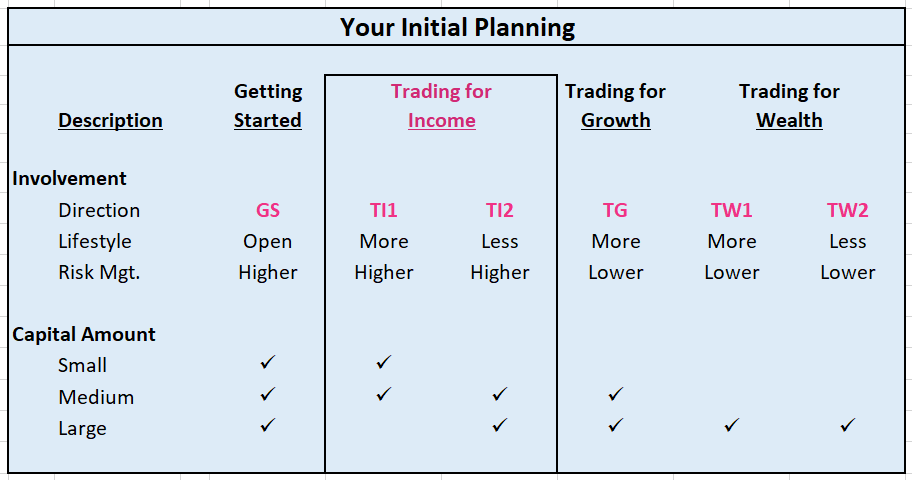

“You have the time to trade your own account and want to learn how to add Intraday Trading to your Wealth Building Plan and produce consistent income with limited market risk” – TI1.

OR

“You’re looking for Income beyond what the financial services industry can produce and want to protect and grow the wealth you have, but you don’t want to spend a lot of time doing it” – TI2.

The Quest for Consistent Income –

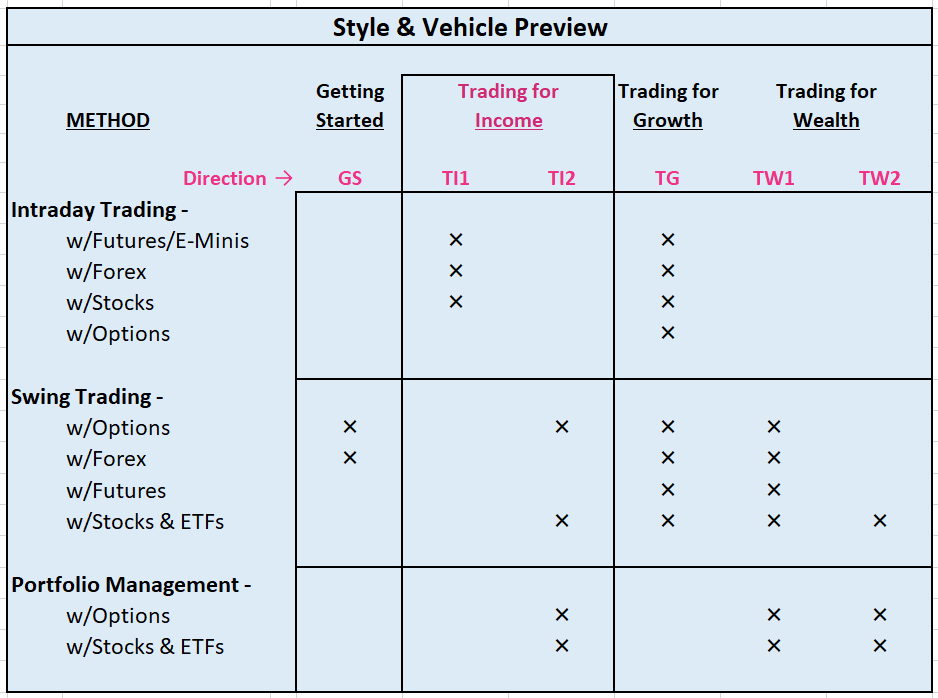

The best things you’ve done so far are getting to know the trading landscape with The Diversified Trader and learning about all the moving parts that make trading systems work and how to manage them. In your Getting Started phase, studying Swing Trading Options and Swing Trading Forex Pairs, the two core Methods you need to know to form the foundation of your Wealth Building Plan, puts you in a great position to move right into the next phase of your plan: Generating income.

Your next logical step will be generating consistent income by adding Intraday Trading (TI1) for the more active plans or expanding your Options experience to include Option Credit Spreads (TI2) as a stand-alone strategy or as part of a larger plan.

At this stage of your development, you’ve been through the Getting Started phase of your Wealth Building Plan and have a good grounding in Swing Trading Options and Swing Trading Forex Pairs, along with the basic market intelligence you need to make those Methods work. That combination is the core of most trading plans and should be the foundation for your overall plan. The versatility you have with that experience will allow you to continue to grow toward your ultimate goal and be able to choose the direction you want to take with a much better knowledge base.

The nice part about having experience in Programmed and/or Technical trading systems, along with the right market intelligence, is that the transition to the next phase will be a lot easier. Your learning curve is much shorter, and you can concentrate on learning the new applications that will put you closer to your goals, without having to start from scratch.

Day Trading Stocks & ETFs, Forex, and Futures – (TI1)

Day Trading with Forex Pairs and Futures, including the E-Mini and Micro E-Mini contracts, provide more efficient Vehicles for smaller accounts due to the lower margin requirements and ease of managing your trades. Day Trading Options reduces your capital outlay and margin requirements, but you still have to abide by the Pattern Day Trading rules, restricting some small account holders. Day Trading Stocks and Options outlines for those with larger accounts how the strategy can work very well in a very familiar arena with good risk management characteristics.

Day Trading Strategies will give you the background of this Style and the viability of using Stocks & ETFs, Options, Forex Pairs, and Futures Contracts in the Day Trading piece of your Wealth Building Plan.

With your experience in Swing Trading as you were Getting Started, you know how the trading systems work and now can apply the same methodology to Intraday Trading and grow from there.

Day Trading, by its nature, is complicated and emotionally charged enough that anything you can do to minimize your involvement in the process will give you an advantage.

Too often, individual traders try to develop a trading system on their own with limited knowledge and find they’re stumbling over their own logic and lack of experience and give up before the light dawns that Trading systems are already available. The years of experience and developmental work that’s gone into these systems cuts your learning curve down to size and provides a platform to develop your own skills. Keeping with my theme of managing all the pieces to your Wealth Building Plan, having good Trading Partners to provide the expertise in the Methods you’re using will give you that advantage.

Helping you find the path to knowing where you’re going with the tools to get there is the basis of my mission, so you can concentrate on your financial future without having to wonder about the outcome.

Focus and Direction play a major role in the success of any wealth building plan. I’ve emphasized this before, but it’s important to note again that getting your education and training from those who have succeeded will put you leagues ahead in your quest to succeed in achieving your goals.

Ongoing Market Intelligence from those who have made trading their business is the missing ingredient in most individual trading plans.

Market news and events influence Day Trading more dramatically than longer-term positions and become important as catalysts for trades and to raise the caution flag when planning an entry or exit. Regularly scheduled events in the financial and commodity markets can add to the process of managing your positions by providing setups for a variety of strategies. So, being aware of the forces influencing the market you’re trading becomes all important, no matter what Method you’re using.

Trading systems and platforms developed by Your Trading Partners with daily support and direction is my choice for making your Day Trading as productive as possible.

Again, independent trading cultures give you differing market intelligence to cover all the bases, with the support and direction you need for consistent success. You’ll want the predictability of trading systems and the certainty of Technical market action to come together to supercharge your results.

You’ll find that your daily trading will be enhanced by the Swing Trading and Market Intelligence you’re already using. And, trading systems are very useful to give you a routine you can develop to generate consistent income every day you trade. Your experience with Swing Trading puts you ahead of the game when you first start to Intraday Trade.

Producing additional income is what you want as you get started.

So, the ease of transitioning to Day Trading is an important advantage. Using the same Trading Partners and expanding into their Day Trading platforms will get you there.

Option Spreads and Portfolio Management – (TI2)

Trading for Income and protecting the wealth you already have is the logical answer when you can’t or don’t want to devote a lot of time to wealth building. Traditionally, you’d be stuck with the fixed income market or “investing” in dividend stocks and taking the risks inherent in the market and having to be satisfied with market returns. Even with a Medium to Large account, your returns wouldn’t be enough to significantly impact your lifestyle or your underlying wealth.

The thing I like about “Managing Your Own Money” is the control you have over the outcome and the higher returns you can get by working with Trading Partners with the expertise in the disciplines you need.

If you had your eye on this direction (TI2) from the beginning as your current goal, get involved with Options and Trading the Stock and ETF markets to get a grounding in how the markets work. Because your primary goal is to develop income producing strategies that require minimal involvement, your emphasis will be on Technical Trading techniques with guidance from your Trading Partner. This sets you up very well to concentrate on creating consistent income and managing your long-term portfolio to fulfill your ultimate goals.

Swing Trading Option Spreads

Generating income is the main focus of this scenario, although it can apply to most wealth building plans as another application of Swing Trading with Options to smooth out one’s growth curve. In this case, though, your objective is to create consistent income beyond what you can get in the market to improve your lifestyle without the time commitment attached to Intraday Trading. Here, you want the luxury of having positions that don’t need much attention and have minimal risk exposure – the last thing you want to do is worry about and have to micromanage every position you have. The best way I found to do that is by Swing Trading Options using Credit Spreads on Stocks, ETFs, and Indexes:

Style – Swing Trading

Vehicle – Options on Stocks, ETFs, and Indexes

Method – Swing Trading Options – Credit Spreads

Systems – Longer-Term Technical

Education is your best asset when it comes to meeting your wealth building goals, and, in this case, making your Credit Spread income strategy a habit – part of your life – will significantly impact your lifestyle and definitely improve your wealth.

Option Credit Spreads on Stock Market Indexes (SPX, OEX, NDX, RUT), Stocks, and ETFs can be used for Swing Trading income strategies with much better risk management than leaving it up to the market to secure your fortunes. I’m emphasizing Credit Spreads is this discussion, but many other Option Combinations are available to enhance your income generating strategy as your sophistication grows. Your Trading Partner’s education and training will bring these variations into play as market conditions warrant.

Understanding Options will get you up to speed on the mechanism of Option Spreads, along with the basics of Options in general. In the section on Credit Spreads, I mention that the Risk/Reward ratio is negative and could be as high as 4/1 or more, and, because of that, good management is important to make the strategy successful. At first, the risk looks too unbalanced to be productive; however, the benefits of the strategy outweigh the negatives and make managing your positions very efficient. The advantages of using Credit Spreads for income are that you can:

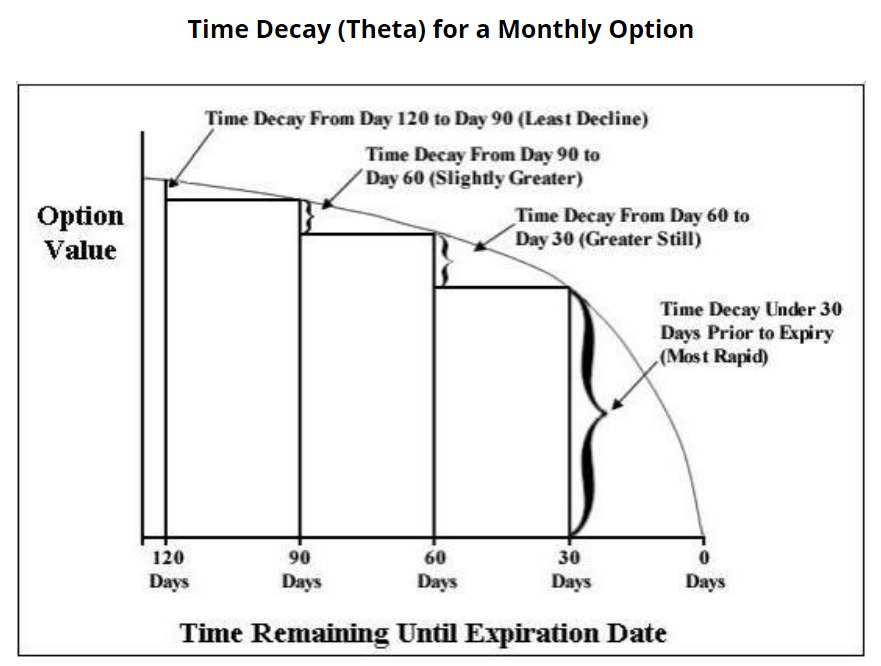

- Take advantage of Time Decay with defined risk. Time is your friend in this case, and the ability to generate meaningful income by only putting 5% of less of your total account at risk makes the strategy very efficient.

- Put the probability of a positive outcome in your favor – the underlying security can move up, down, or sideways and you can still make a profit.

- Manage your positions when the market goes against you. By using all the option variables, you can adjust your positions to turn losing trades into winners.

- Control Volatility. Volatility doesn’t impact Spreads nearly as much as single Call or Put options due to the combination of the Long and Short positions.

- Have consistent results over time. With the right management and the right underlying securities, a high winning percentage can translate into compound growth, a much-overlooked advantage of using Credit Spreads in the right way.

To emphasize the obvious: Knowing the markets to trade and the condition of the “market” at all times puts you in a position to know when to use Credit Spreads to your advantage. Having the right input and management is the key to success.

You don’t have to manage your Option Spread positions alone – use your Trading Partners to make Credit Spreads an integral part of your overall wealth building plan.

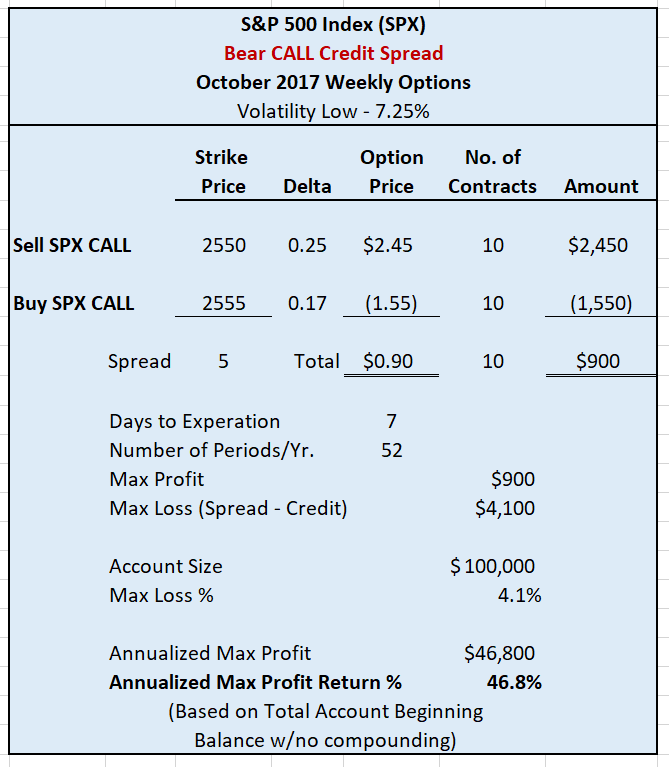

With consistency and good risk management, the seemingly lower returns and higher transaction costs (two positions vs. one) can hide the true returns you can get over time. To make the point, here’s an example of one weekly Credit Spread to show the structure and potential annualized return:

This is hypothetical, of course, because it’s only based on one week and the annualized return is only to show the performance of that one week with no fees or losing trades. With simplicity in mind, my objective is to show the potential of the Method, not the actual application. If you add in compounding as your account grows, fees, and an 80 percent success rate, your actual dollar results would be approximately the same as in the example above. To get a feel for the success ratio, the Credit Spread is positioned at the “expected move” level, so the risk is in the middle range between aggressive and conservative. That said, the variables you’ll face, highlighting the need for good management, are:

- Using multiple underlying securities at different times to take advantage of ideal market conditions for the Credit Spread. This allows for consistent application of the strategy that leads to higher returns.

- Compensating for Volatility to maintain a high positive outcome ratio. Higher volatility means higher option prices, but it also means greater moves by the underlying security. Both situations contribute to the need for good risk management.

- Concentrating on risk management to never incur the Max Loss. This is the most active part of the strategy and is the major contribution your Trading Partners can make. By adjusting or exiting your position prior to expiration, you should be able to contain any adverse moves to break-even or better.

- Structuring your Credit Spread for current market conditions. This is part of risk management and is the next best thing your Trading Partners can provide.

Portfolio Management

Protecting your wealth and adding a conservative growth component rounds out this scenario. With a Medium account size or better, your income strategy should only be using 5% or less of your available funds to manage, so you’ve got the rest of your account available to add longer-term opportunities and continue building your base.

Here’s where you can start looking at Stocks and ETFs coupled with longer-term Options.

This is not the time to trust the traditional marketplace to give you any help – you want to have control over the outcome. Take a look at my definition of Portfolio Management; it’ll give you my perspective on how it fits into your overall wealth building plans.

At this stage, using only Stocks, ETFs, and longer-term Options is the most efficient choice when the objective is growth with less management over a longer timeframe. Along with generating the income you want, protecting your wealth with adequate growth meets your goals and can very well secure your lifestyle.

With my definition of Portfolio Management, you’ll be “trading for long-term growth” and using the market fluctuations to generate wealth by looking for different length Trends in the markets you trade.

Longer-Term Swing vs. Shorter-Term Trend Trading

NASD 100 ETF (QQQ) Weekly Chart

Borrowing a chart from Swing Trading, you can see the Short-Term Trends develop along a Longer-Term Trend. History tells us that the Bull market continued with the last up-arrow, so being in the market with the shorter trends paid off in the long run and kept you in the market to take advantage of the longer trend. Trying to pinpoint the start of a long-term trend in any market is difficult, to say the least, so having the shorter-term trend mentality, both long and short, will give you the risk management you need not to get caught in a long-term momentum shift.

Right now, I’m emphasizing the management of the long-term portion of the less active individual’s wealth building plan, but this introduction can form the basis for any plan when you’re getting near the level where you’ll be Trading for Wealth. Starting in the “less active” arena:

The most conservative approach you can take is to stay in cash and work on your income strategy – the potential returns are far better than any traditional offering and you only put a small fraction of your wealth at risk.

Beyond Income, if your objective is to also protect the rest of your wealth and at least stay ahead of inflation, depending on the level of your involvement, you have two basic avenues to implement conservative growth strategies:

One is to take advantage of Programmed Systems (preferably using Artificial Intelligence) that offer pre-programmed trading strategies where you follow the strategy built by the developer.

The other is to use a Technical System within a service that offers trading advice and recommendations for a longer-term horizon.

You control the outcome in both cases, but your involvement increases with the complexity of the system. The more you control the system, the more you’ll have to manage.

For trading for income and portfolio management, Technical Systems fit the bill for longer-term, hands-free management.

In most instances, your involvement is primarily in your learning curve, and the systems generally take little management after that initial period. You’ll still be trading for long-term growth, but the key is to keep the level of activity low and balance your involvement with the goals you’ve set for your conservative growth plan.

Your Trading Partners will be the key to making everything work.

Finding The Right Path to Consistent Income –

Whether you concentrate solely on generating income or use these strategies as a part of a larger wealth building program, the benefit of the two Income Methods we’ve developed here cannot be overrated. Besides income, a major advantage is to have a strategy for managing uncertain market conditions, so you can maintain consistency and a positive growth curve in a diversified wealth building plan.

Portfolio Management comes into play when your account size gets to be or already is large enough to overcome your risk parameters for your Income strategies. To make these Methods work to your advantage, expand your trading knowledge and choose the path that’s right for you:

Add Day Trading

Day Trading Stocks & ETFs, Forex, and Futures for the more active scenarios can add just the right mix to manage your portfolio for consistent growth. As the “rule of thumb” goes: the more uncertain the market – the shorter your trading strategies should be. Intraday Trading fits the bill, and Forex and Futures trade almost continually during the week, giving you added leverage over the “market”.

Start a Passive Income Strategy

Swing Trading Option Spreads can generate substantial income over time with little hands-on management and enhance any wealth building plan or be used independently for extra income in all market conditions. Having good knowledge of the “market” with the right expertise guiding you along the way is a prerequisite for success – knowing what to trade when.

Look to the Future

Introducing new systems for longer-term portfolios here gives everyone the opportunity to judge where their next step is going to be after mastering the shorter end of the trading curve. I also wanted to introduce Portfolio Management systems at this stage, because they can also be used for shorter-term Swing Trading and are useful for a variety of markets. One major benefit is being able to match your Swing Trades to the overall Trend for better performance.

The rest is history, when all your trades (Long and Short) end up creating that smooth growth curve in your portfolio, proving you’ve found the Holy Grail of Trading: Consistency + Compounding = Exponential Growth.

Make It a Reality

One Way or The Other,