Day Trading Strategies

Day Trading Stocks & Options –

The original definition and practice of Day Trading was specific to the very active trading of Stocks for minuscule gains on multiple trades throughout the day. With the intensity involved and the unfortunate experiences of the retail trader in the early days when the concept was introduced, Day Trading Stocks soon became the quickest path down the Abyss and was logically left to the professionals.

Today, Day Trading Stocks is alive and well for all Markets in the hands of those professionals.

Individual traders now have the luxury of having access to professionals who provide the wherewithal to make the Method a success. I’m writing about Stocks and Options separately since the application of the method is unique, and it falls under the Pattern Day Trading rules from the SEC, requiring larger account balances.

Go to Day Trading Stocks & Options to get some insight into how to trade those Markets and connect with Your Professional Day Trading Partner to give your Wealth Building Plan the consistent income you’ll need to meet all your goals for Income, Growth, and Financial Independence.

Day Trading Forex Pairs & Futures – Alternative Markets

Forex Pairs and Futures Contracts, including the E-Minis and Micro E-Minis, are efficient Vehicles for individual traders to use for the Intraday portion of their Wealth Building Plan, especially for those with limited capital to trade.

Depending on what individual Market you trade within these two Vehicle classes, you’ll have two other major Methods, along with Day Trading Stocks and Options, to use to achieve your Intraday Trading goals. If you’d like to review how these Vehicles work, take a look at The Futures Market and How to Trade Forex.

I found that trading the Futures markets, especially the E-Mini contracts, gave me the added experience and knowledge I needed to manage my longer-term portfolio more productively.

In fact, combining Day Trading Stocks and the Futures Markets increases the productivity of your Day Trading due to the influence Futures have on the Stock market. Trading Forex Pairs also gets into the mix by quantifying the macroeconomic forces impacting the world markets.

Day Trading Methods are a great complement within the Style and to the other Styles in your Plan, because they keep you in the market and abreast of ongoing market intelligence, so important to managing your overall portfolio. You also get greater flexibility in managing your growth curve through all market conditions. As with the other parts of your Wealth Building Plan, education is the key to learning how to create and manage your own wealth, and Day Trading can be an important part of that education.

I created The Diversified Trader to give you the platform to create your Wealth Building Plan and choose all of its parts, so you wouldn’t have to search through the confusing maze of alternatives that make up the individual trading landscape.

If you’re thinking about expanding your Wealth Building Plan, Day Trading with Futures or Forex can give you added flexibility to provide the consistent income you’ll need to balance your portfolio as market conditions change – it’s a good way to diversify by Style and Method.

The Advantages

Using the Forex and Futures markets as options for Day Trading stems from the need of the individual to have flexibility in the overall trading process to help overcome market forces beyond their control. The retail trader is at a disadvantage as it is, because of limited reaction time, and needs various markets to overcome the volatility in the market. As all markets change their character over time, a “rule of thumb” in the trading sphere is to decrease your holding time as volatility increases, and Intraday Trading using multiple markets provides that flexibility. The benefits of using Forex and Futures for intraday trading are:

Limited Number of Symbols allowing for greater focus on market behavior and knowing the markets you’re trading. The whole idea is to capture short-term momentum; so, having a shortlist of high volatility, liquid symbols gives you far greater control and a much higher rate of success. Some people just trade the S&P 500 E-Mini Futures Contract (ES) – now, that’s focus. Markets have a habit of going through periods of low volatility, though, so I like to have a few more options to be able to always have an active market to trade.

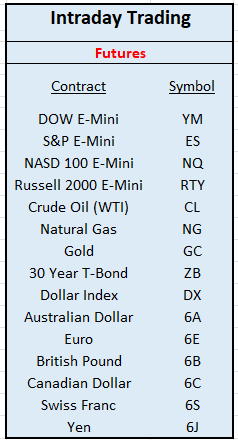

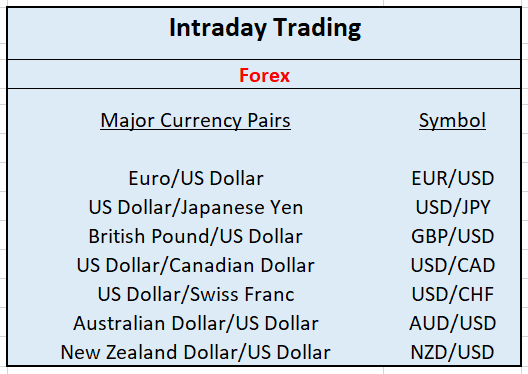

Traders in the Futures and Forex markets, including Your Trading Partners, have their own list of symbols that they know very well. So you can see the extent of what is required, listed below are the Futures and Forex Pairs that I’ve used at various times. As market conditions change, the lists you’ll be using will be different and follow the criteria used by your trading services. You really don’t need any more than a group of symbols like these to make Intraday Trading a success.

Trading Hours that are basically around the clock (Futures and Forex take a short break every day to reset) for five and a half days a week. This gives you far better control over your entries and exits, because you’re not constrained by exchange hours, and the continuous market makes analysis more efficient. Everyone looks to these markets to get a reading on what’s going to happen in other related markets, so, as an intraday trader, you have a leg up going in. For people outside the market time zones, this helps them to trade on their schedule, especially in the Forex markets that have worldwide coverage.

Lower Margin Requirements to be able to trade with less capital (the Pattern Day Trading Rule doesn’t apply here) and create more leverage that greatly enhances returns. Leverage also increases risk, so having a good education and gaining experience is critical before diving into intraday trading. Forex trading has the higher leverage of the two and has its own risk management parameters.

Lower Transaction Costs on Futures and no commission on Forex Pairs (Forex brokers use the Bid/Ask Spread to replace a direct commission structure) add to the attraction of these Vehicles. In addition, tight Bid/Ask Spreads make Futures and Forex more efficient for Intraday Trading.

Flexible Work Hours make Day Trading Futures and Forex attractive for many different lifestyles. Besides being able to trade at different times of the day or night, you generally only need two hours or less per day to generate the income you’ll need, so you’re not tied to a computer screen all day.

The Risks

Risk Management is the primary focus in any trading Method. When you’re dealing with the leverage inherent in the Futures and Forex markets, control of the risk component becomes even more important.

The good news is Forex and Futures Stop Orders work very well.

An industry saying – Cut your losses short and let your winners run – wraps the concept of risk management in a very nice package. Trading in general and Day Trading in particular is based on probabilities of success and maintaining a positive win/loss ratio. That’s the essence of risk management and the measure of success.

High volume Futures and Forex markets by their nature are less susceptible to manipulation, making risk management more efficient. The Forex market is so large that any intentional manipulation is not a problem. In any event, I always enter a “combination order” where the Stop Order is entered at the same time as the primary order. This guards against sudden, unexpected market fluctuations and technical problems dealing with power outages and other unforeseen interruptions.

Making It Work

Your dedication to the process will create your success. The Diversified Trader is here to narrow the search for the right training and to emphasize the importance of having a plan with multiple Styles and Methods to minimize your risk and substantially increase your success rate over time. Day Trading is one piece of the puzzle and should take its place with Swing Trading and Portfolio Management to round out your Wealth Building Plan.

The key to success is in your education and training and having the right tools to take advantage of market fluctuations and stack the probabilities in your favor.

By their nature, Day Trading Forex & Futures and Day Trading Stocks & ETFs can be stand-alone Methods or used together to build the financial life you’ve always wanted. The education you get learning how to trade the various markets over time can easily give you the basis to make a living and create your own lifestyle.

How to find the best path to taking control of your financial future, without all the detours, is what I want The Diversified Trader to help you determine.

I like to start with Day Trading Forex primarily because of the lower capital you have to put at risk to get started and the limited number of symbols to manage. For traders in the U.S.A., Forex Futures are available as a more stable alternative to using the pairs. If you haven’t already, take a look at How To Trade Forex to get a more in-depth knowledge of the market and the risk parameters involved before you start any Trading and/or Education services.

As you transition to live trading and for those experienced traders among us, from scalping some pips every day to Swing Trading the Major Forex Pairs, you’ll be in a position to make your long-term goals come true.

Day Trading Futures can easily be incorporated in your trading plan with either Stock and/or Options trading, and you don’t need a large account to get started. For Futures Contracts, especially the E-Minis and Micro E-Minis, the process is the same for all markets, and adding Futures into the mix will give you more flexibility to manage your account and get the consistency you want. Futures don’t fall under the Pattern Day Trading rules, so you can start Day Trading with a smaller account balance by using E-Mini and Micro E-Mini Futures.

To make Day Trading a part of your business of wealth building, your education and training should come from multiple, independent sources to give you the control over the outcome that comes with having the diverse knowledge that will give you the tools to succeed. The market intelligence and direction you get from independent technical analysis puts you way ahead of the curve in achieving consistent results.

Make It Your Business

Here’s to Building Success,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

- If you’re new to trading, in Getting Started I emphasize Swing Trading Options on Stocks & ETFs and Swing Trading Forex Pairs as the best places to start your education and will give you the foundation to be able to add the income generating capability of Intraday Trading to your Plan as it develops.

- To make all that happen, if you haven’t already, get to know all about Education – The Path to Independent Wealth Management. Then, to put your knowledge into action, The Diversified Trader – An Overview will get you started on the right path to developing your Wealth Building Plan.