Trading with Stocks – A New Look with a Silver Lining

A Look at What We Call “The Market” –

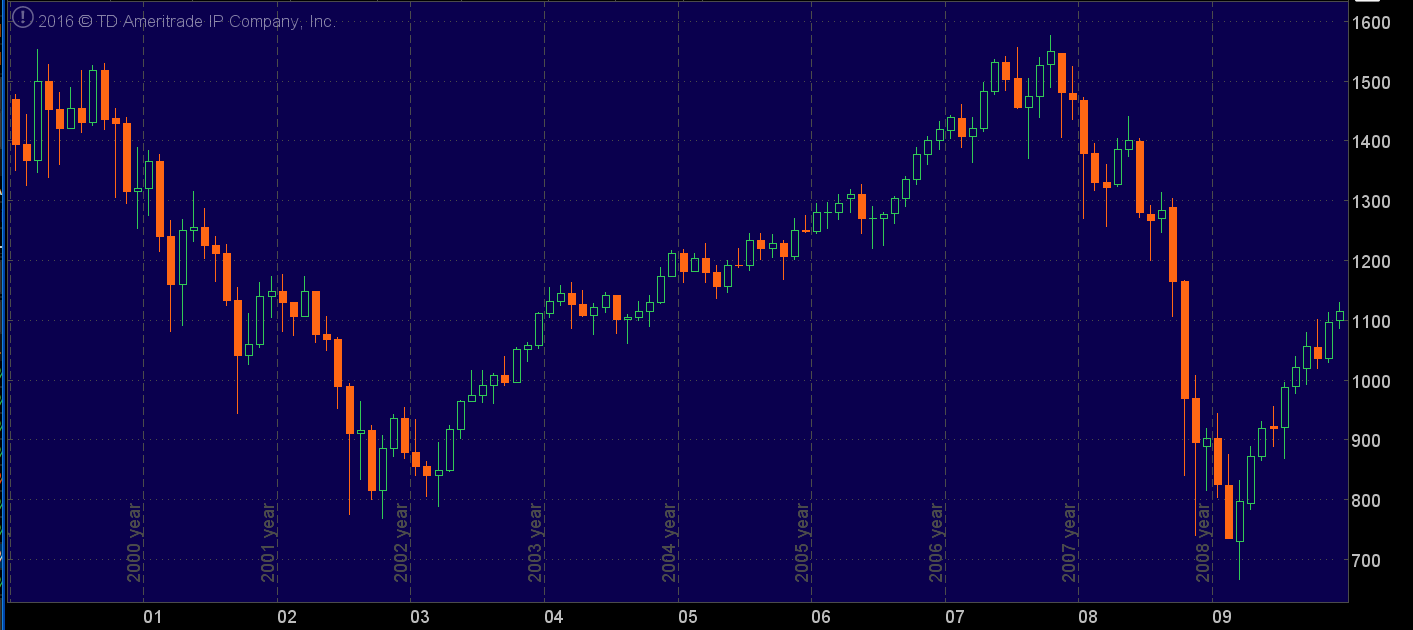

I chose the S&P 500 Index, the most recognized representation of the U.S. Stock Market, and the first decade of the 21st century to make a point about Investing in Stocks and your financial well-being.

The S&P 500 Index (SPX) – 10 Years

By Month

1/2000 to 12/2009

The chart of the S&P 500 above shows the precarious nature of the “Market” and letting it determine your financial future, and, by extension, how dangerous “buy and hold” investing really is. The odds of picking the right stocks at the right time consistently are very low, and investing for the long-term would have seen negative returns in your portfolio over the above 10 year span. Can we really afford to let that happen?

Read on to find the Silver Lining in this scenario.

This “buy and hold” approach is a strategy out of the past, when information available to the retail investor emphasized the viability of business and the growth that stocks provided over long periods of time.

Unfortunately, those periods of time are too long and proper timing too important to have any meaning for the individual investor.

The state of technology at the time and the associated brokerage expenses made it extremely cumbersome for the retail investor to participate in the stock market. Mutual Funds grew in popularity over time, as a way to get the retail investor involved, and Asset Allocation Models and an emphasis on Diversification by asset class became the preferred method of trying to beat the market at its own game.

However, none of that worked very well. With astute planning and market timing, one could gain an advantage over the market, but, for most of us, that luxury is not part of our DNA. Neither, it seems, is it a part of the institutional marketplace — most professional managers only achieve market returns or worse. So, any reliance on the financial services industry to grow your wealth leaves you in the same position – at the mercy of the “market”.

A New Look – The Silver Lining

However, the chart of the S&P 500 does show that harnessing volatility and using it to your advantage can make the difference between success and failure in your quest for consistent growth and financial security.

Many of the financial products we have today never even existed in the “buy and hold” days. So, the landscape has changed. Today, information technology and the discount broker have put us in a position to individually manage our wealth and take advantage of market volatility. Options and ETFs alone have opened up a world of opportunity for the individual wealth builder, not to mention having access to the commodity and world currency markets through inexpensive online brokers.

Learning to Trade stocks, rather than Invest in stocks, opens up so many avenues for managing your wealth through all market cycles – long-term and short-term, in up markets and down markets.

Look at the stock market and individual stocks as the “engine” that’s going to make your Wealth Building Plan work, without depending on the whims of the market to determine your financial well-being. I look at it as “Short-term Trading for Long-term Growth”.

Let the market work FOR you, not AGAINST you.

One of the reasons I created The Diversified Trader is to help you find your answer to making independent wealth management happen. Using different Styles and Methods of trading, rather than trying to figure out which stock or asset class you should buy and hold, will give you the structure of your Wealth Building Plan, and Your Trading Partners will have the tools and expertise to make your Plan a reality.

A Look at Stocks – The Most Common Vehicle

When people talk about the “market”, they usually mean the Stock Market. The S&P 500 Index in the chart above is the most common metric used in the industry to judge the health of business in the United States of America. Markets all across the globe look to the U.S. for leadership in all things and especially in business, represented by the public “stock market”.

Popular Stocks Known by Their Moniker “FAANG”

(Made famous by Jim Cramer on CNBC)

Facebook (FB)

Amazon (AMZN)

Apple (AAPL)

Netflix (NFLX)

Google (GOOGL)

Most of us are familiar with stocks, either through the products we buy or having bought stocks for our long-term investments through savings plans at work or for our own account. Businesses go to the public market to raise money to expand or operate their business and typically sell shares in their company, known as Common Stock, for that purpose. Individuals and institutions then can buy those shares through Exchanges organized to provide a market for the efficient management of the transactions.

Brokers at different levels provide access to the exchanges for the general public and institutions, completing the cycle of private equity funding through creating the final loop to form an efficient marketplace.

This is the most basic form of participation the public can have in the private sector business arena that provides the engine that makes the greatest economy on earth work and prosper. Businesses have other sources of funding, including Bonds, Preferred Stock, short-term domestic and international borrowing, and an infinite variety of other financing combinations, but for this discussion and as a part of your wealth building plans, Common Stock will be the focus.

Exchanges & Markets

In the United States, the primary exchanges for trading stocks are the New York Stock Exchange (NYSE), the electronic market of the National Association of Security Dealers (NASDAQ), and the American Stock Exchange (AMEX), currently a part of NYSE Euronext. World Exchanges with the most quoted indexes are London (FTSE 100), Japan (Nikkei 225), Germany (DAX), and Hong Kong (Hang Seng).

The financial institutions usually have access to the exchanges through direct membership and act as their own broker. The retail trader has available many brokers in every market segment. To see a review of the most popular ones, have a look under Brokers on my Helpful Trading Sites page to get some insights.

The basic building blocks for creating wealth from the organized markets – the underlying products from which value grows – are made up of the financial and commodities markets. All the “derivatives” you’ll be using (ETFs, Options, Indexes, Futures, and Currency Pairs) are related to one of those markets. In building and managing your portfolio, the four basic “engines”, or original markets, that you’ll use to create and grow your wealth are:

- Equities – All Classes of Stocks.

- Debt Markets – Corporate Bonds, Treasuries, etc…

- Commodities – Crude Oil, Natural Gas, Heating Oil, Sugar, Gasoline, Gold, Corn, Wheat, Soybeans, Copper, Soybean Oil, Silver, Cotton, and Cocoa are among the leaders in trading volume.

- Currencies (Major) – U.S. Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swiss Franc (CHF), Australian Dollar (AUD), and the New Zealand Dollar (NZD).

How you use these markets and what proportion each serves in your portfolio will be determined by your Wealth Building Plan and the many factors that make up your goals and dedication to achieving control over your financial destiny.

With the many “derivatives” available, the opportunities to build a portfolio with consistent growth and controlled risk is definitely within reach.

The concept of “short-term trading for long-term growth” and using the fluctuations in the markets to “run” your portfolio and not having to depend on picking asset classes or individual stocks, flies in the face of traditional advice offered by the financial services industry.

The change in mindset necessary to grasp the significance of the difference and its long-term influence on one’s well-being is one of the most important steps you can take to finally control your financial future.

Stocks are one of the primary Vehicles that people use for trading and investing and are understood by more people than the other basic markets. Now, we can look at stocks in a different light – using stocks and all their derivatives as tools to manage your Wealth Building Plan, rather than depending on them for your financial success.

Fundamental vs. Technical Analysis

I wanted to explore these two different techniques that people use to analyze stocks to give you a basic understanding of what they are and how each could be used. The underlying difference in the two techniques is in the time horizon and goal inherent in each activity.

- Fundamental Analysis is used for Investing in securities, by definition for the long-term, and determining the worth of the company for growth over time.

- Technical Analysis is involved in Trading securities over a shorter-term period based on price and volume data and using technical indicators for direction and momentum with the aim of taking advantage of market volatility.

Fundamental Analysis would be used by the “buy and hold” crowd and falls into the category of “value investing”. This is the technique used by Warren Buffett; so, there’s nothing bad about the concept, considering the goal. The objective is to determine the “future value” of a company and buy and sell shares based on that knowledge. Achieving that value could be years in the making, and the stock would be subject to market volatility along the way.

The fundamental analyst looks at the financial statements of a company (basically the Income Statement, Balance Sheet, and Cash Flow Statement) to start building a case for an investment. Earnings and other company data used for analysis are released normally on a quarterly and annual basis, emphasizing the long-term nature of the goal. The length of time and complexity of the analysis is determined by the analyst and could start with looking at the financial statement ratios (Price/Earnings Ratio, Price/Book Value, Debt/Equity, Return on Equity, Current Ratio, Margins, and others), along with evaluating dividends, research and development, new products, competition, and market sentiment. Current activity is looked at only after the analysis is complete and to judge the viability of the investment.

Technical Analysis at its core, to the purist, is based on the belief that the history of any security is reflected in its price at the moment. Looking at the chart of the security, in all its variations, will give the analyst all the information needed to make buy and sell decisions, or so goes the theory. In practical application, technical analysts will use a variety of tools, including fundamentals and technical studies in relation to price action, to determine direction and duration. Volume and order flow come into play with some techniques; so, the variety of systems and goals can be as varied as the people using them. Some of the technical tools you’ll run across are:

Candlestick Patterns

Support and Resistance Levels

Momentum Studies

Overbought and Oversold Indicators

Pivot Points

Moving Averages

Volatility studies

Directional Strength Indicators

Volume, Order Flow, and more…

Take a look at my Chart Setup for All Seasons to see how I look at the market and what I’ve found to be a very efficient setup for monitoring various market conditions and specific situations. As you develop your Wealth Building Plan and start working with the education and trading services here, you’ll learn specific applications of technical analysis appropriate to the Method of trading in that part of your Plan.

Wrap Up

It seems, at first glance, that Fundamental and Technical Analysis would be completely different approaches to managing your wealth. However, both camps can benefit by combining the two to the degree necessary to increase the probability of success.

One could base an investment decision on the Fundamentals and then use Technical Analysis to enter and exit the position.

Any single technical indicator can’t be used on its own to make trading decisions, and using a group of technical studies only puts the odds of success in your favor; so, using stock specific and market fundamentals greatly improves the viability of the trade and knowing when the underlying security is ready for a move. An extension of classic fundamental analysis is to look at the factors influencing any particular security at any point in time. Market sentiment and specific pressures on the security need to be known before technical analysis can perform its function. The more you know about a security, the more technical indicators will mean to the success of any trade.

By qualifying a group of securities through market fundamentals, you increase your probability of success, and then Technical Analysis gives you the tools to enter and exit trades to produce the consistence growth pattern you want.

Scanning the universe of stocks for certain technical characteristics can uncover some good candidates, but finding the right ones among the resulting group is actually harder than working with a pre-qualified set of stocks. An intangible benefit of working with a select list is that you get to know the characteristics of the securities and gain confidence in their behavior in relation to the technical studies you’re using. I’ve included a list of stocks that I look at based on liquidity, high option volume, and narrow Bid/Ask Spreads to get you started. The individual education and trading services here at The Diversified Trader will have their own take on what markets are best for their style of trading.

Since an integral part of my mission is to structure your Wealth Building Plan not to be at the mercy of “the market” and have the market work for you, picking stocks on a fundamental basis alone is counterproductive. Having a list of stocks you can “trade” for long-term growth makes the most sense for the retail wealth builder.

Diversifying by Trading Style and Method puts YOU in charge – not “the market”.

Here’s to Taking Stock in Your Financial Future,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

- If you’re just getting started, read all about My Mission and learn the importance of education that will be the guiding light to your financial future by reading Education – The Path to Independent Wealth Management and grow your own Plan for long-term growth.

- To make all that happen, learn the easiest way to get started improving your financial condition by letting The Diversified Trader – An Overview find the right path to creating your own Wealth Building Plan and making it work.