The Futures Market

The Short-Term Trading Advantage –

Futures Contracts for Commodities, Currencies, Treasuries, and Stock Market Indices –

Originally used for agricultural commodities to manage future price risk and to ensure an orderly marketplace, the commodity Futures market has since expanded to include energy and precious metals. Financial Futures came into being in the early 1970’s, and, since then, Currency, Interest Rate, and Stock Market Index Futures have played an ever increasing role in the Futures arena. The players fall into three groups:

- Producers – Farmers, oil companies, miners and others use Futures to hedge price volatility, locking in a price for their goods for future delivery.

- End Users – Here, Futures are used to protect against price changes in the future. An airline will hedge the price of oil, food companies will hedge the price of their basic commodity, and anyone doing business in foreign countries will hedge currency exposure to maintain stable profit margins. Large money managers use Futures to hedge their portfolios.

- Speculators – As very important market players (including us retail wealth builders), these institutions and individuals provide the liquidity necessary to provide an efficient marketplace for the producers of commodities and the various hedging needs of companies worldwide.

With the advent of the E-Mini Futures contracts (smaller versions of the regular contracts) introduced in 1997 by the Chicago Mercantile Exchange, the individual trader has had much greater access to the futures market. So much so, that now the S&P 500 Index E-Mini contract leads the pack in volume.

Recently added Micro E-Mini Futures contracts (1/10th the size of the E-Mini contract) for the major indexes (S&P 500 – MES, NASD 100 – MNQ, Russell 2000 – M2K, and the Dow – MYM) will allow greater access to the market for the smaller account traders of the world, adding to the volume already established by the E-Minis.

So, understanding the futures market and how it can impact your future then becomes critical to building a well-balanced Wealth Building Plan.

My mission here at The Diversified Trader is to help you diversify by Trading Style and Method, and a subset of that diversification model is to have alternative Vehicles to make it all work. All markets have their “down time” or consolidation phase, so having alternative, non-related choices available makes your Wealth Building Plan so much more productive. The many ways Futures can help include:

- Intraday Trading with the E-Mini Index, Crude Oil, and Gold Futures can be the answer for a choppy or lackluster stock market. This is one of the better Intraday Trading arenas due to more favorable leverage metrics (lower initial investment for the return), but the strategy needs constant attention and a fair amount of training to be able to produce consistent results. Education and involvement with specialists is the key to your success in this market. For those with the time and patience to learn this style of trading, the reward can be substantial.

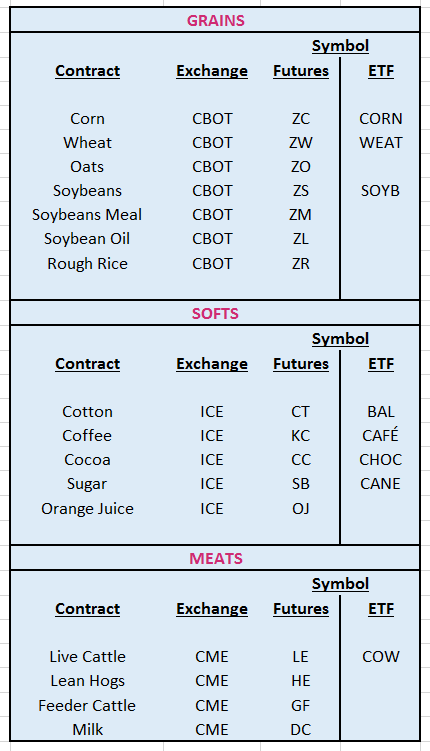

- Swing Trading can be enhanced by using Commodity and Financial Futures. Liquidity in the Futures market is, by all accounts, more important due to the leverage those futures contracts offer (more on this in the next section). The higher leverage increases the volatility in your invested capital, and any wild swings in the price of the futures contract can impact your balance very quickly and by an inflated amount. So, being able to enter and exit your position efficiently with a tight spread becomes a key component in your decision about which contract to trade. It’s in the low volume commodity markets where wild price swings are common and problematic. Currently, the more liquid commodity markets are: Crude Oil, Natural Gas, Heating Oil, Sugar, Gasoline, Gold, Corn, Wheat, Soybeans, Copper, Soybean Oil, Silver, Cotton, and Cocoa. Commodities go in and out of favor, so the trader should be aware of volume, current vs. historical, when making trading decisions.

- Swing Trading Options on Futures is also available and provides a risk management tool in the individual Futures markets. Where risk is unlimited when you buy or sell a futures contract, when you buy a Put or a Call option your risk is limited to what you paid for the option. The mechanics of these options are the same as other options, and the basics can be reviewed at Understanding Options. When you sell an option your risk is also unlimited, as it is when you sell any option, but can be used in combination with futures contracts to limit exposure. The premium paid for the option also comes into play when compared to trading the futures contract itself. The premium paid has to be subtracted from the gain in the option, whereas the futures contract has no such “cost” to enter a position, however, both have transaction costs. So, a lot of study has to go into trading these markets and whether to use options in the mix or not.

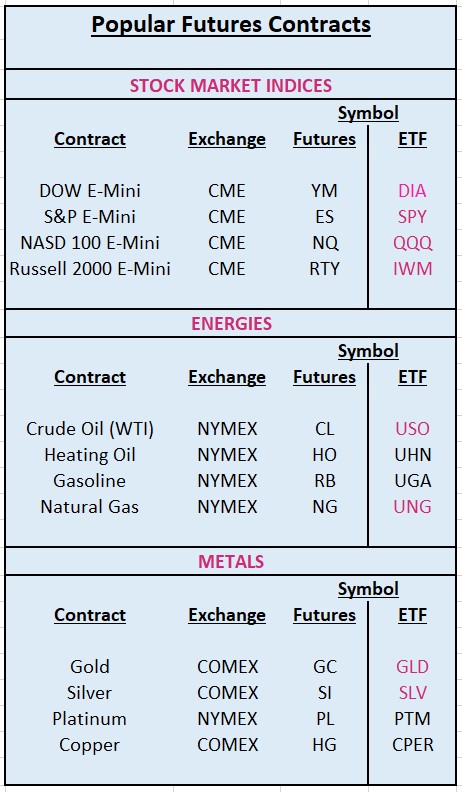

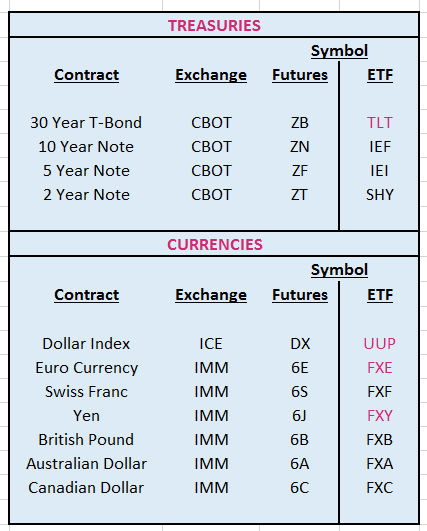

- Swing Trading Futures ETFs and Options on those ETFs. For Swing Trading and longer-term positions, high volume ETFs that track Commodity and Financial Futures, without the leverage inherent in these markets, provide the ideal way to enter these markets and manage your portfolio in a more passive environment, along with your other positions based on other markets. And, with Options on those ETFs, you can gain a lot of the leverage that is the hallmark of the Futures market. With liquidity being so important, I’ve highlighted the high-volume ETFs in red in the list of Popular Futures Contracts below. You can also find them, along with others, in my list of High Option Volume ETFs.

High volume Futures contracts are most popular for Intraday Trading among retail traders and for more specialized trading plans for longer term positions. Large professional traders take up a significant part of the latter market and can provide insight into market movements for the retail trader (see the link at the end for the “Commitments of Traders” Report). The benefits, I’ve found, in using Futures in your Wealth Building Plan are:

- Having alternative markets to trade within the Method of trading you’re using. As mentioned above, the purpose is to have non-correlated markets to provide additional “engines” for that trading Method. Don’t confuse this approach with the concept of diversification sold to the unsuspecting investor by the financial services industry.

- Having a limited number of viable symbols to trade. With liquidity governing your choices, having a defined number of markets to analyze and track gives you the ability to “know your market” and be able to concentrate on the fluctuations in those markets that will give you the best trading opportunities.

- Low margin requirements for Intraday Trading. There is no mandated account balance; the Exchanges set the Initial Margin (see below) for trading. Trading intraday in the Stock and ETF markets has a Securities and Exchange Commission (SEC) account balance minimum requirement of $25,000; so, the futures markets provide the smaller account holder with this very lucrative opportunity to begin taking control of their financial future.

- Watching the Futures markets to be able to anticipate market moves overnight. Futures markets trade almost 24 hours a day from Sunday night to Friday’s close; so, they’re very good to use for monitoring what markets are doing around the world.

The Anatomy of a Futures Contract –

A Futures Contract is a standardized “forward contract” to buy, or deliver, a predefined quantity of a commodity or financial product at a specified future date. Contracts are traded on futures exchanges which provide the marketplace for buyers and sellers and run the Clearinghouses that manage “margin” requirements and absorb the risk between the parties to the futures contracts. The world’s major futures exchange is the Chicago Mercantile Exchange (CME) and, along with the Intercontinental Exchange (ICE), makes up the bulk of the futures trading on the planet. Over the years the CME has greatly expanded its services, introducing electronic futures trading in 1987 with its GLOBEX platform, and has acquired numerous other exchanges to make it the powerhouse it is today. The CME became listed on the New York Stock Exchange in 2002 and then in 2007, with its market and financial strength, merged with the Chicago Board of Trade (CBOT). In 2008 the CME acquired the New York Mercantile Exchange (NYMEX), along with the Commodity Exchange (COMEX), and rounds out its holdings with the International Monetary Market (IMM), which specializes in currency and interest rate futures.

The exchanges control the orderly flow of contracts and eligibility to participate through limits. Volatility in the marketplace is managed by setting daily price fluctuation limits, and position limits are set to ensure against manipulation of the contract price by any one entity. Everyone trading in the futures market is required to have a minimum amount of money (margin requirement) in their account before buying or selling a futures contract. Set by the exchanges, the three requirements to watch are:

- Initial Margin – This is the amount of “good faith” money a trader has to have per futures contract before trading. It’s not the same as the margin you deal with in the stock market, where you’re actually borrowing money from your broker to buy stock. Initial Margin represents a “security deposit” amount to deal with fluctuations in the market and absorb any losses that might occur during the day.

- Maintenance Margin – Less than the Initial Margin, this is the amount of money you must maintain in your account to continue holding your position into the next day’s trading. If your account balance falls below this level, your broker will ask for funds to be deposited immediately to bring your balance back up to the Initial Margin amount.

- Margin Call – The process your broker uses to request the additional funds required to bring your account up to a tradeable level. Check with your broker for their policy, but, in general, they have the right to liquidate your position in the event that funds are not received in a timely manner. Futures provide great leverage as we’ll see below, but that can also work against you — nobody wants to get the dreaded Margin Call.

Margin requirements are reset daily; so, “Vigilance” is a good word to have in mind when trading the futures markets. Since futures are active almost 24 hours a day, stop loss limits are a lot more productive and imperative to have in an unlimited risk environment. I always enter combination trades, where I enter the Stop Loss along with the futures contract I’m trading. This way both orders go in at the same time, mitigating any coincident risk – like a power outage or erratic market behavior. Weekends may be a challenge, though, and your trading strategy will dictate how you handle this risk. As a retail, risk averse wealth builder, I never hold over the weekend.

Futures Contracts have expiration cycles; so, like Options, they will cease to exist as of a certain date and the contract will be “settled”. But unlike Options, Futures Contracts have been bought and sold. When you buy a contract, you are going “Long” the market, and when you sell a contract, you are going “Short” the market. So, no matter what, you have to cover your position at expiration – one side profits and the other side loses. For speculators, the contracts are settled in cash, so there’s no need to make a counter trade in the underlying market. Producers and End Users settle contracts in cash also and then trade the commodity in the cash market. Financial Futures are all cash settled.

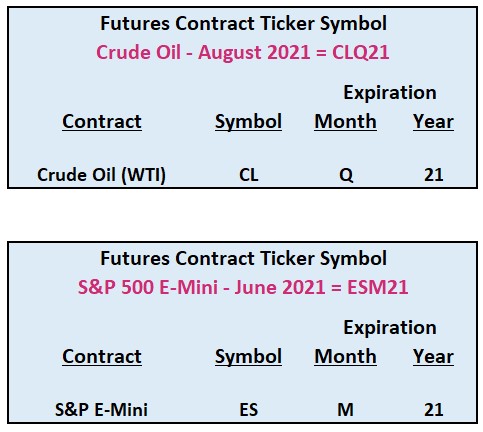

Futures symbols are constructed to show the Contract Symbol, Expiration Month, and the last two digits of the Year. Every futures contract has different expiration cycles, expiration dates, and Initial Margin calculations; so, to “know your market” becomes very important in this arena. In the example below, the Crude Oil August 2021 contract expires on July 20, 2021, and has monthly expirations. The S&P 500 E-Mini contract example below is more normal and expires on the Third Friday of June, but its expiration cycle is quarterly (March, June, September, and December).

The Futures Ticker Symbol examples here will give you a start in learning the basic structure, and the list below will show you the expiration cycle months and their designated letters used in the ticker symbol.

Expiration Month Letters

| Month | Letter |

| January | F |

| February | G |

| March | H |

| April | J |

| May | K |

| June | M |

| July | N |

| August | Q |

| September | U |

| October | V |

| November | X |

| December | Z |

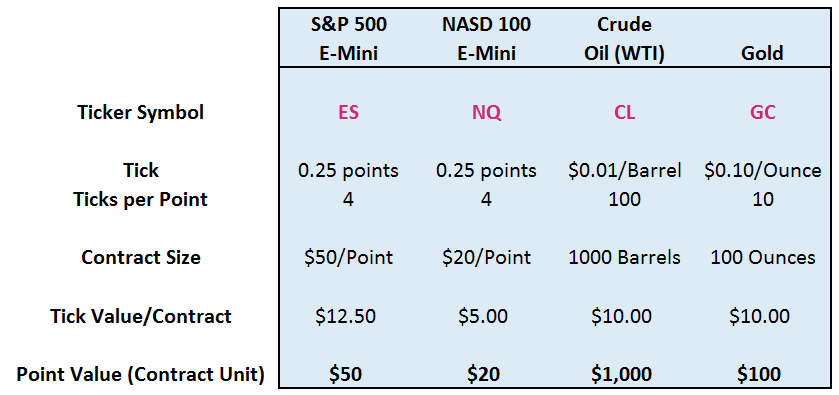

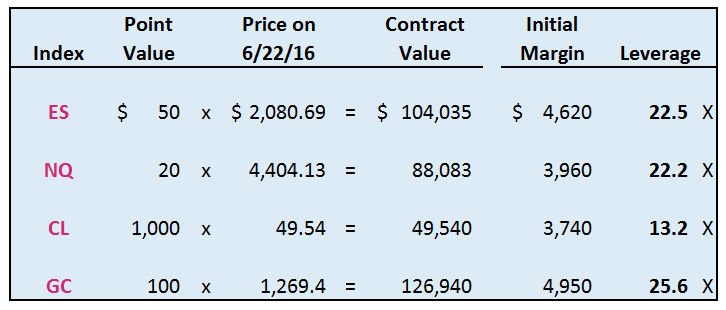

Leverage in the Futures markets gives a trader the opportunity for outsized gains with relatively low margin requirements, but, considering the characteristics of a futures contract, the risk of outsized losses is just as great. We’ve talked about liquidity being important for getting in and out of positions with ease and vigilance a must in trading these markets; so, let’s take a look at what degree of leverage is involved. For this exercise, I’m going to be looking at the S&P 500 Index E-Mini (ES), the NASD 100 Index E-Mini (NQ), Crude Oil (CL), and Gold (GC).

The first metric we’re going to look at is Point Value, or Contract Unit. For every one point move in the underlying index, the futures contract will gain or lose this amount. The calculation looks like this:

The Point Value then can be used to determine the value of one contract by multiplying it by the price of the underlying to get the Contract Value. By using the Initial Margin amount as the measure of your invested capital, you can see in the table below how significant the leverage is that’s built into these markets.

Hopefully, this overview gives you a head start in understanding how the Futures market can be an integral part of your Wealth Building Plan. As an Alternative Vehicle, Futures can add to any Wealth Building Plan and give you the right mix to greatly increase the productivity of your wealth building journey. The risks are built in, but with good management and the right expertise in the markets being traded, the journey can be enhanced by adding Futures to your financial future.

Alternatives Give You Options

Here’s to Expanding Horizons,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

What’s Next

- To get a start in the world of wealth building in all types of markets, including the Futures market, and form a good foundation for success, begin with the basics of the journey by reading Education – The Path to Independent Wealth Management.

- Then, if you’re not already in the loop, learn the best route to your financial future by following the steps outlined in The Diversified Trader – An Overview.

For further study and research into the Futures markets, visit:

Chicago Mercantile Exchange (CME) – Home Page

Chicago Mercantile Exchange (CME) – S&P 500 E-Mini Specs

BarCharts.com – Futures Contract Specs

BarCharts.com – Futures Expiration Calendar

BarCharts.com – The Commitment of Traders (COT) Reports