Trading Systems – The Difference is Technical

Why Different Trading Systems Matter –

As an introduction to the subject, I want to point out that there are different approaches to Systems development that range from super-computerized to having subjective trading rules that the trader applies in the decision-making process. The challenge is to apply the right system within the framework of a trading Method you’ve identified for a section of your Wealth Building Plan. It’s important to quantify some guidelines for the Systems you’ll be using, so you understand how to manage any Method that’s part of your Plan. You’ll be looking at the Methods you need, along with the underlying Systems your Trading Partners have developed.

A Method is the combination of Style and Vehicle.

A System is developed to fulfill the needs of the Method.

Having a disciplined set of rules as a guide is the hallmark of a good system. Having a management process to fit the underlying parameters to changing market conditions is the secret to having a successful System. Remember, Systems come and go and are only as good as the developers that created them and the management that keeps them up to date and tuned to the everchanging market.

As you execute your Wealth Building Plan, your Trading Partners will develop the Systems to run the Method being used, and it’s your choice which System best fits your needs, experience level, and personality. The extent of your involvement in the Systems being used is to manage the output for the appropriate section of your Plan within your chosen Methods.

Artificial Intelligence (AI) is being developed more and more to be used in Trading Systems to improve results and consistency. One of the great advantages of AI is that it will allow the System to adjust to market conditions on a real time basis, eliminating the need to second-guess the market. As AI makes inroads into the Systems used by the retail wealth builder, the advantages of using AI based Systems will multiply and, I think, will produce the next major step in allowing individuals to be able to take control of their financial future with more certainty.

Trading System Categories

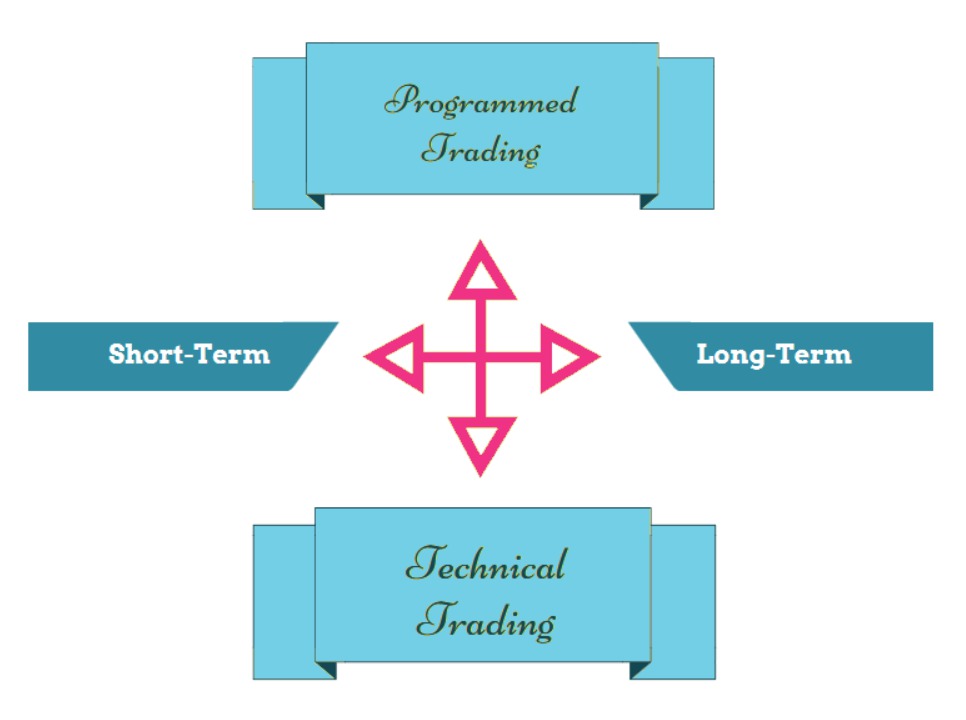

Of all the trading systems out there in the marketplace, I’ve been able to define the best of them as belonging to two broad categories within the dominant Styles of Trading (Intraday Trading, Swing Trading, and Portfolio Management) that I like to call:

- Programmed (System) Trading – A proprietary computer program built based on technical analysis indicators and other assumptions to produce a self-contained system that automatically generates signals to be followed by the trader. You generally buy and learn the program with education and support from the supplier and trade based on the rules established within the program. Here’s where AI based Systems will provide the next generation of programs to make the individual wealth builder’s life a lot more productive. Currently, the field can include programs you use to build your own trading system and extensive, professionally built systems traders implement with no individual input. Not to be confused with “Program Trading”, which refers to institutional programs initiating trades based on algorithms created to take advantage of specific market conditions, like the much-touted High Frequency Trading (HFT) programs.

- Technical Trading – Trading rules are established through education and training and require the trader to manage the rules independently. A variety of techniques are formed with the use of technical indicators, multiple time-frame analysis, market analysis, and other inputs to create a System that fits the market being traded. I include Intraday Trading “on price action alone” in this category, since the technique is based on chart patterns and knowledge of what those chart patterns mean. Technical Trading is the most common approach and requires a good knowledge of the industry and development of parameters relating to the market being traded. For an example of what indicators could be used and the related charts, take a look at my Chart Setup for All Seasons. It all boils down to developing rules to follow when trading, and the success or failure of any system depends on the one developing the rules. Needless to say, this opens up a can of worms, and developing your own system or finding a system that actually works becomes a huge challenge.

So, we’re looking for skilled management with superior systems to make the Methods in our wealth building plan work. Well managed systems, whether Programmed or Technical, make up the foundation of our trading life and are the tools we use to produce the results that will meet and beat our goals.

The Method is the Trading Plan, and the System is the execution mechanism.

The whole field of system development is so large, with so many players, that trying to quantify any reasonable approach to deciding on what to follow becomes a lifetime of research. The problem you run into in the marketplace is not knowing what works and what doesn’t, and, if you try everything to find out, you’ll spend a lot of money and time and still end up not achieving much success. Besides, that is not the job of the individual wealth builder. Happily, I have found a variety of talented people that have devoted their lives to certain trading Methods and have developed Systems that work.

I want to emphasize that we’re looking for exceptional trading systems by experts dedicated to their Method of trading that fit into your overall Plan.

Don’t get caught up in the hype about any particular system changing your life and making you instantly into that consistent trader. Look for organizations that have been built by dedicated experts with a history of accomplishment and work with them. They have the pulse of the market and the experience to make their systems work.

Finding those dedicated experts to make your Wealth Building Plan work is a primary mission of The Diversified Trader.

To that end, I brought in Your Trading Partners that best exemplified my criteria for partners that you could depend on to help you manage the Methods in your Wealth Building Plan. The partners unique philosophies and expertise fit very well into my vision for how you, the individual wealth builder, can succeed at achieving your goal of taking control of your financial future, without having to evaluate the systems that will get you there.

Your Trading Partners

The Key to Success

Keep Learning From the Pros

To the Technical Side of Life,

Ted Bliss

Your Research & Development Coordinator

TheDiversifiedTrader.com

If you’re not already in the loop, get a head start on navigating The Diversified Trader and finding the right path to taking control of your financial future by reading The Diversified Trader – An Overview.